Spot Bitcoin (BTC) exchange-traded funds (ETFs) saw significant daily inflows of over $200 million. Uncertainty around US inflation data dominated the market.

Investors are reassessing their positions in risky assets, including Bitcoin ETFs, as inflation fears rise. These developments highlight the complex relationship between macroeconomic indicators and the cryptocurrency market.

Market Anticipation Drives Bitcoin Fund Selling

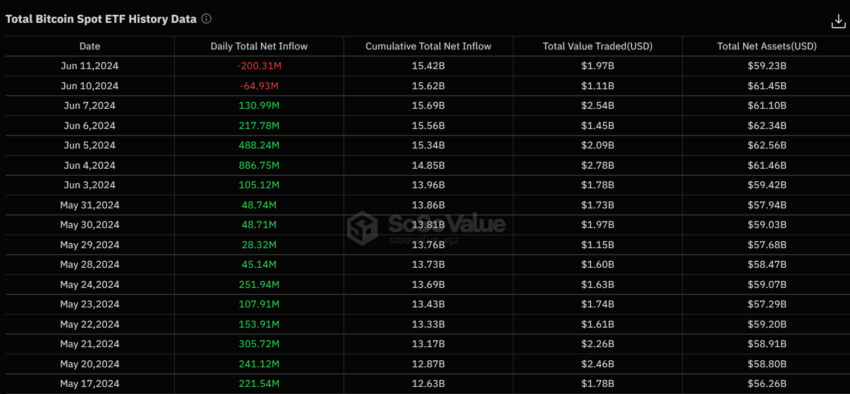

Data from SoSo Value shows that US spot Bitcoin ETFs saw a daily net inflow of $200.31 million as of June 11. Bitcoin Trust (GBTC) and ARK 21Shares Bitcoin ETF (ARKB) were hit the hardest, with outflows of $121 million and $56 million, respectively. Meanwhile, BlackRock's iShares Bitcoin Trust (IBIT) saw no inflows during the same period.

Read more: How to protect yourself from inflation using cryptocurrency

This change is notable, as these ETFs have seen positive inflows since May 13. However, releases started happening from June 10. Market participants were expecting the US Consumer Price Index (CPI) data to be released today.

Jesse Cohen, global markets analyst at Investing.com, also noted the increased market volatility surrounding the upcoming CPI report. He noted that a colder-than-expected CPI report could extend the market's ongoing rally. This reassures investors about possible rate cuts from the Fed in the months to come.

He added“However, a surprisingly high inflation figure could lead to market volatility, as it could delay expectations of interest rate cuts and raise concerns about inflationary pressures.”

The research company “Resala Kobeissi” also participated. He highlighted shared expectations regarding the CPI data. The company noted that although major banks expect CPI inflation to be at 3.4%, forecast markets indicate a 17% chance of inflation being above 3.4% and a 41% chance of inflation being above 3.4%. below 3.4%.

“CPI inflation above 3.4% (today) means inflation has increased 3 times in the last 4 months,” I wrote Kobeissi's message.

Mixed economic signals further complicate inflation expectations and market performance. For example, U.S. businesses added 272,000 jobs in May and wages grew at an annual rate of 4.1%, while the unemployment rate rose to 4%. This paradox of an increase in employment and wages associated with an increase in unemployment adds to economic uncertainty.

Matthew Dixon, CEO of cryptocurrency rating platform Evai, highlighted the crucial nature of the upcoming CPI-Fed meeting. He recognized the real risk of rising inflation, which would be positive for the dollar but negative for risky assets, including Bitcoin.

And he said: “It is also possible that we see a slowdown in the CPI and a dovish Fed leading to an increase in risk assets.”

However, he leans Bitcoin Price Historically, rebounds after FOMC announcements despite initial volatility. A cryptography researcher under the pseudonym Gumshoe noted this in his latest analysis.

"There were 4 FOMC (meetings) in 2024. (...) BTC dropped 10% in the 48 hours before each one. On the day of the FOMC, it retraced the entire move. The market always overprices bearish data and then reverses,” Gumshoe explained.

Learn more: Bitcoin (BTC) Price Forecast for 2024, 2025, 2026, 2027

As the market prepares for impending inflation data, it appears Instant Bitcoin ETF Feeds Sense of caution among investors. The results of the US CPI report and the Federal Reserve's subsequent actions will likely set the tone for market movements in the near term.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, action or decision taken by the reader in accordance with this information is solely the responsibility of it and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,البيتكوين,العملات الرقمية,العملات المشفرة

Comments

Post a Comment