Amid the volatility of the cryptocurrency market, stablecoins, which are cryptocurrencies linked to stable currencies like the US dollar or the euro, remain a safe haven for investors.. Tether (USDT), the largest digital stablecoin, is facing strong competition that threatens its market dominance.

The stablecoin market continues to grow... especially given uncertainty over currency volatility

With the decline in the value of Bitcoin (BTC) and entry into the market Digital currencies In a correction phase, stablecoins are gaining more and more traction among investors. Thanks to its relative stability and its connection to reliable assets such as the US dollar. This makes it an attractive alternative to other cryptocurrencies in times of extreme volatility on trading platforms.

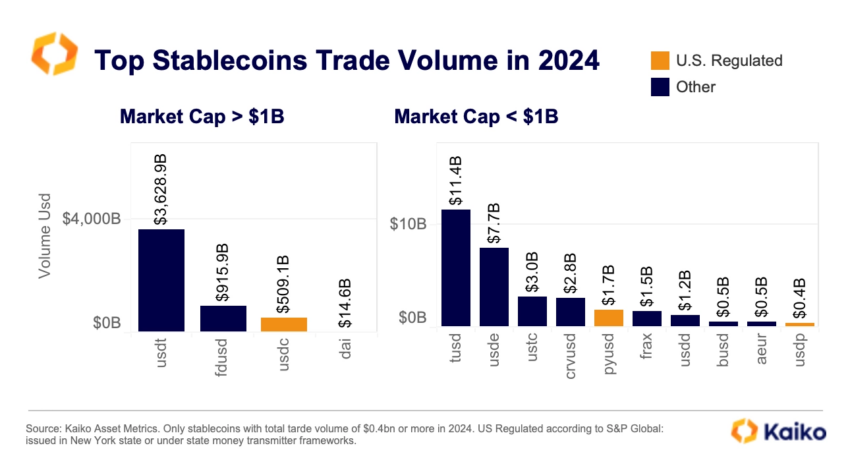

Currently, stablecoins backed by the US dollar and the euro account for the majority of cryptocurrency transactions. It represents 82% of total trading volume, compared to only 18% for trading cryptocurrencies against traditional currencies.

As the cryptocurrency market is on the rise, Tether (USDT), the reigning stablecoin by market capitalization, is facing increasing pressure that threatens its industry dominance. Especially given the growing dynamism of the market and the new challenges it faces.

👈Read more: Stable Digital Currencies What You Should Know!

According to a study conducted by Kaiko Research, the market share of Tether (USDT) in... Central stock exchanges (CEX) is down significantly. In the language of numbers, Tether's market value has decreased from 82% to 69% since the beginning of this year (2024).

Factors Threatening Tether (USDT) Dominance in the Stablecoin Market

Although competition in the stablecoin market has already intensified with the entry of new players such as FDUSD, Tether still maintains its dominance at the top of stablecoins in terms of trading volume, with over $3.6 trillion traded in 2024 alone, surpassing its nearest counterpart. Its competitors are USDC from Circle and FDUSD from First Digital.

Adding to the challenges of Tether (USDT) dominance is growing investor interest in regulated stablecoins such as USDC and... PYUSD. Which are subject to US regulations on money transfers, which constitutes a significant factor in destabilizing control of USDT.

For example, USDC's market share increased from 1% in 2020 to 11% today. This indicates a growing inclination among users for currencies that offer more security and legal force. Meanwhile, the market value of PYUSD increased from $44 million at the beginning of last September to $327 million. (At the time of writing this article).

👈Read more: Everything you need to know about the digital currency USDT and how to buy it & PYUSD: What should you know about it?

The emergence of innovative solutions like Ethena's USDe, a stablecoin offering a yield, could also weaken Tether. USDe, which launched last February, saw a significant increase in trading volume, surpassing that of USDC during the same period.

Finally, the stablecoin market is experiencing explosive growth, driven by investors' desire to find a safe haven in a context of cryptocurrency volatility. While Tether is consideredUSDT) is the undisputed leader in this field, and its dominance faces increasing challenges. Including security concerns, regulatory pressures, and the growing popularity of regulated stablecoins such as USDC and PYUSD.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المستقرة,العملات المشفرة

Comments

Post a Comment