Bitcoin miners begin to feel the pressure as rewards diminish in their new reality After halving.

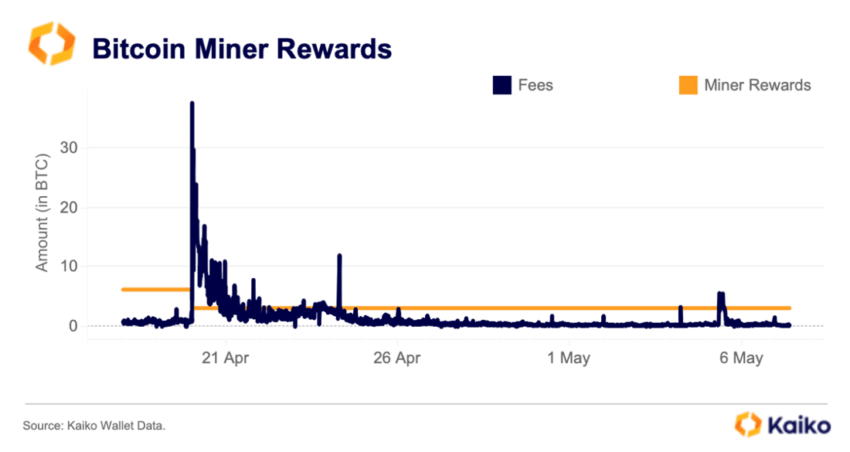

A sharp rise in network tariffs briefly eased the pressure. However, falling transaction fees are now adding to financial pressures.

Post-Halving Pressure on Bitcoin Miners Increases Amid Falling Fees

A report from research firm Kaiko Research noted an increase in average daily rates on the network after the halving. This rally helped Bitcoin miners relieve some pressure, albeit temporarily.

However, the Initial enthusiasm for the Runes protocol (Runes) declined. According to Dune Analytics, Rheon transactions decreased by more than 4,500%. It went from 753,814 on April 24 to 16,630 on May 14.

Additionally, halving events often force miners to sell Bitcoin (BTC) to cover the costs of creating new blocks. Although the higher fees helped alleviate some of the selling pressure,... Recent drop in fees This can renew these pressures.

The report stated:

"For example, Possess Marathon Digital holds 17,631 BTC worth over $1.1 billion, while Riot Platforms holds 8,872 BTC worth over $500 million. “If mining companies are forced to sell even a small portion of their holdings over the next month, it will have a negative impact on the markets.”

Seasonal challenges and high mining costs

Additionally, trading activity and liquidity typically decline during the summer. Last August, the market liquidity level fell 2% to a low of $250 million. This seasonal decline could further complicate the situation for miners and the cryptocurrency market in general.

Cryptocurrency analyst Maartun supported Caico's research findings, pointing out that Bitcoin miner profitability has fallen to its lowest level in three years. He said:

“Bitcoin miners are facing a significant drop in returns due to the recent halving of block generation costs and relatively low transaction fees. This is likely to cause significant stress, especially for miners at the lowest levels. less effective."

Despite the current situation, cryptocurrency analyst PlanB sees a brighter long-term future. PlanB said Bitcoin miner revenues will rebound in 2-5 months as the price of Bitcoin (BTC) doubles.

AndExplain Plan B:

“(In) 2012: revenues decreased (from) $3 million (to) $1.5 million, still in two months (in) 2016: (revenues) decreased (by) $60 million ( to) $30 million, in 4 months (in) 2020: (revenues) fall (from) $500 million (to) $250 million, in 5 months.

As Bitcoin miners weather the post-halving storm, their financial resilience is being tested. Volatile fees and market conditions present challenges and opportunities. With an expected recovery in miners' revenues, the coming months will be crucial for the stability and growth of the sector.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة

Comments

Post a Comment