Bitcoin ETFs were spot traded in the United States Back to entries Worth $116.8 million last week. After four consecutive weeks of capital outflows exceeding $1 billion.

The Grayscale fund was the only fund to record outflows of $171.1 million, although it ended a 78-day outflow streak by recording inflows of $63 million on May 3 and $3.9 million last Monday.

As for BlackRock Fund BlackRock (IBIT) saw its first daily releases on May 1st. But it recorded revenues of $48.1 million last week.

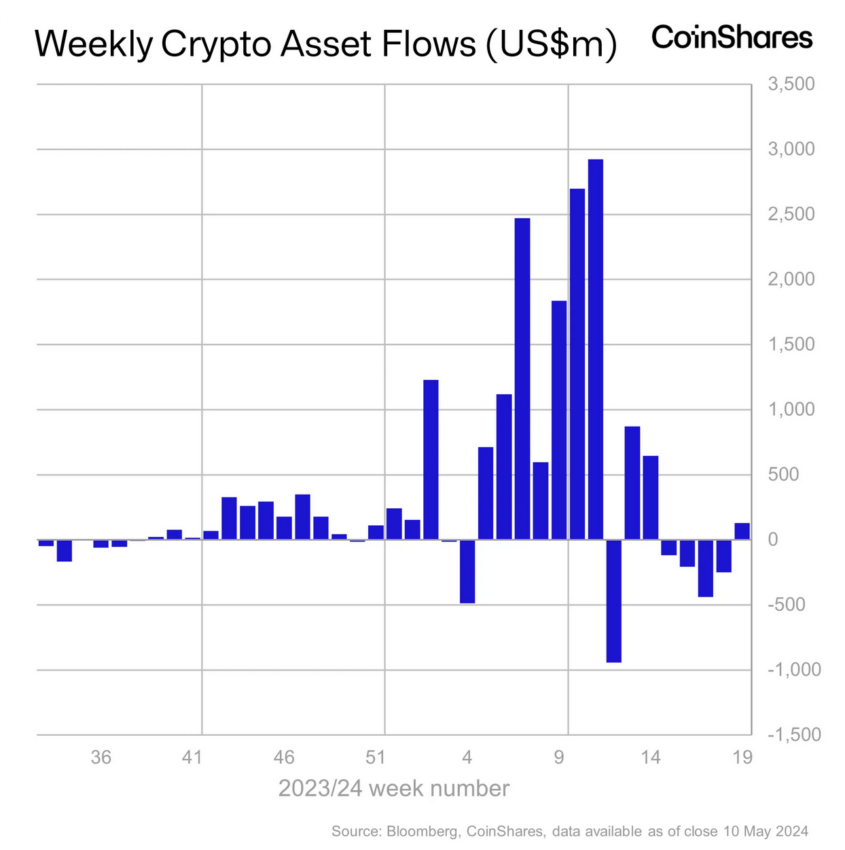

Overall spot Bitcoin ETF inflows have declined significantly since their March 12 peak. Daily net inflows reached $1.05 billion. This decline coincided with a 23% drop in the price of Bitcoin, from its all-time high of $73,836 on March 14 to $56,500 on May 1, before rising back to around $62,700 currently. Therefore For the weekly report From CoinShares Monday.

Low trading volume

Trading volume of spot Bitcoin ETFs in the United States fell to $7.4 billion last week. This is after reaching $11 billion the previous week.

The decline in volume was once again reflected in the global market for cryptocurrency trading products. It fell to $8 billion last week, compared to an average of $17 billion in April.

And he wrote James Butterville, Head of Research at CoinShares: “These volumes highlight that ETP investors are currently less involved in the cryptocurrency ecosystem. They represent 22% of total volumes on trusted global exchanges, up from 31% last month.

Daily trading volume fell dramatically after hitting a record high of $9.9 billion on March 5 – as Bitcoin surpassed its previous cycle peak of around $69,000 for the first time.

However, the total trading volume of US spot Bitcoin ETFs since their launch on January 11 surpassed the $250 billion mark last week and now stands at $254 billion.

Enthusiasm for Bitcoin and Ethereum Spot ETFs Diminishes

Enthusiasm for spot Bitcoin ETFs appears to have calmed, with monthly net outflows in April reaching $343.5 million, ending a three-month streak of inflows. Although last week's net inflows are a positive sign. However, it is unclear whether these results indicate a long-term reversal of this trend.

In contrast, Ethereum ETF investment products saw net outflows last week amid... Optimism wanes Regarding the prospects of approval of Ethereum spot ETFs in the United States.

It remains to be seen whether recent influxes are an indication Long-term transformation On the Bitcoin spot ETF trend in the US and whether enthusiasm for Ethereum spot ETFs will return in the future.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,الأسواق,العملات الرقمية,صناديق ETF

Comments

Post a Comment