The recent development of Ethereum (ETH) exchange-traded funds (ETFs) by the United States Securities and Exchange Commission (SEC) has had a significant impact on the crypto investment environment.

After the SEC's initial approval of Ethereum spot ETFs, Bitcoin (BTC) counterparts continue to see positive inflows.

US cash ETFs rise amid renewed optimism

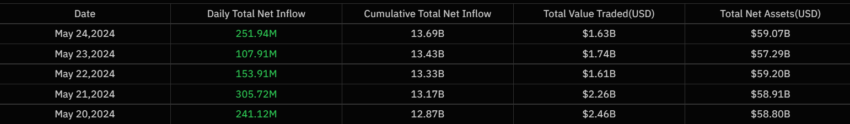

Data from SoSo Value reveals that as of May 24, the net inflow of spot Bitcoin ETFs into the United States was $251.94 million. This represents ten consecutive days of Flows. On the same day, iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) received $182 million and $44 million, respectively.

Meanwhile, the Grayscale Bitcoin Trust ETF (GBTC) received no inflows on the same day. This is notable given the streak of negative flows for US spot Bitcoin ETFs from late April to early May.

Learn more: Ethereum Price Forecast in 2024

In fact, the Ethereum Spot Fund The crypto market has been infused with renewed optimism. BeInCrypto reported that Ethereum and some of the tokens in its ecosystem have shown impressive performance since Monday.

However, it is important to note that Ethereum ETFs have not yet been officially launched. SEC approval for S-1 filings is awaited. James Seyphart, an ETF analyst at Bloomberg Intelligence, expects Ethereum spot ETFs to “take a few weeks.” But it could take longer” to be traded on the market.

"Typically this process takes months. In some examples, up to 5 months. But Eric Balchunas and I believe this will be at least somewhat accelerated. We will know more." almost".

However, Experts remain optimistic. Another ETF analyst, Eric Balchunas, predicts that Ethereum spot ETFs could capture “10-15% of Bitcoin spot ETF assets.”

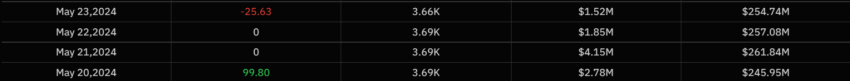

Despite renewed interest in the US market, Hong Kong spot ETFs saw a sharp rise Relatively poor performance. Data shows that from May 20 to 23, spot Bitcoin ETFs in Hong Kong saw no inflows for two consecutive days. Meanwhile, their Ethereum counterparts saw an inflow of just 62.80 ETH on May 22.

Read more: Best Mobile Cryptocurrency Wallets in 2024

However, a recent report indicates that the regulator is located in Hong Kong. It plans to include staking for Ethereum spot ETFs. This is particularly interesting as potential issuers in the United States have been withdrawing stakes from their deposits. By including staking rewards, Hong Kong Ethereum spot ETFs can provide a competitive edge, providing additional yield for investors.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,أخبار أسواق العملات المشفرة

Comments

Post a Comment