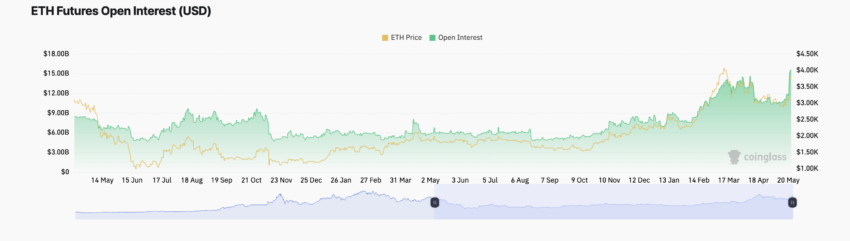

Open interest in Ethereum futures has increased (ETH) to a record high of $16 billion amid the recent rise in the overall cryptocurrency market.

This rise comes as the leading altcoin attempts to reclaim the $4,000 price level and climb towards its all-time high of $4,891, which it reached three years ago.

Ethereum futures traders place more buy orders

As of this writing, open interest in ETH futures stands at $16 billion. Its most recent uptrend began on May 19 and has since risen 45%.

ETH futures open interest measures the total number of futures contracts for the currency that have not yet been settled or closed. When it increases in this way, it indicates an increase in the number of market participants entering new positions.

Assessed year-to-date, open interest in ETH has increased by 69%.

Additionally, the rise in open interest for ETH futures comes with a positive funding rate. As of this writing, the ETH funding rate is 0.014%.

Funding rate refers to the periodic payment made between traders in the futures market for an asset to ensure that the contract price remains close to the spot price.

When the funding rate is positive, traders who hold long positions pay those who hold short positions. This usually happens when the futures price is higher than the spot price. Which indicates a higher demand for buying than selling.

Learn more: Ethereum Price Forecast in 2024

The combined reading of high open interest and positive funding rate for ETH indicates significant bullish activity in the coin futures market. This means that the number of market participants opening new positions and holding the altcoin in anticipation of the rally is increasing.

ETH price prediction: at Yays

Confirming the continuation of the upward trend, it was ROI (RSI) for ETH is in an uptrend at press time. With a value of 71.21, the momentum indicator indicates that market participants prefer to accumulate more ETH rather than selling their coins.

Additionally, the coin's Chaikin Money (CMF), which tracks liquidity flows into and out of the ETH market, has settled above the central zero line at 0.22.

A CMF above zero indicates market strength, which indicates high capital inflow.

If the inflow of “new money” into the ETH market continues to increase, the coin could leave the $3,790 level behind to trade at $3,838.

Learn more: Ethereum (ETH) Price Forecast for 2024, 2025, 2026, 2027

However, if profit-taking ensues and declines resurface, ETH price could fall to $3,633.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,إيثريوم,العملات الرقمية,العملات المشفرة

Comments

Post a Comment