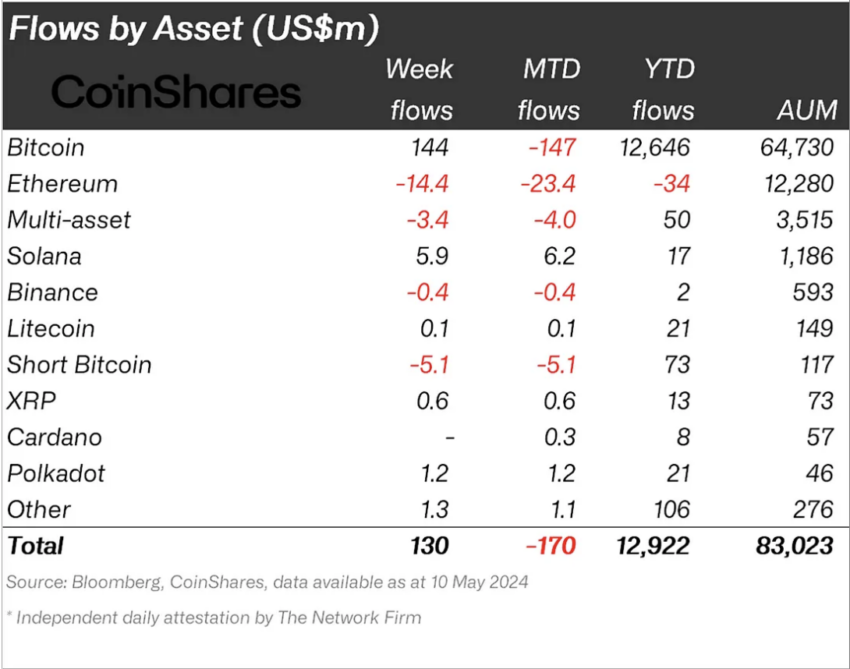

For the first time in more than a month, cryptocurrency investment products saw net inflows totaling approximately $130 million, primarily in the United States, according to a recent report from CoinShares.

This major shift represents a positive shift in investor sentiment after weeks of stagnant or negative growth for various crypto assets.

First streams in 5 weeks totaled $130 million

This rebound in investment activity is largely due to inflows into Bitcoin, which received around $144 million last week. This is in line with broader market trends. Which indicates Renewed investor confidence despite persistent challenges.

On the other hand, the United States continues to make progress in the cryptocurrency market. Flows reaching $135 million. This strong performance demonstrates the country's central role in the global cryptocurrency market, even as the regulatory landscape evolves. Meanwhile, Grayscale reported its smallest influx since January. For a total of $171 million, an indication of a potential stabilization of investor appetite.

Learn more: Why is it better to invest in digital currencies in 2024 than to trade?

The scenario seems less optimistic in Hong Kong. The region recorded a modest inflow of $19 million, indicating a slow response to recent market opportunities, e.g. Launch of a Bitcoin ETF. This poor performance may indicate a cautious or bearish outlook on the part of Asian investors regarding immediate future gains.

Amid these developments, Ethereum continues to face challenges due to approval delays. Ethereum ETF in the USA. A recent analysis by research firm 10X Research indicated a possible decline in the price of... Ethereum at $2,500, indicating weak fundamentals and a reduced role in the current market cycle.

“The weak response from US regulators to requests from ETF issuers for the Spot Ethereum ETF has increased speculation that approval of the ETF is not imminent, and this has been reflected in outflows totaling 14 million dollars last week,” the 10X Research analyst said.

Additionally, overall ETP participation in the crypto ecosystem has declined, accounting for only 22% of total trading volume. This equates to a 31% decrease from the previous month. This change indicates a diversification of investment strategies from traditional ETFs towards perhaps a more dynamic or diversified approach.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة,بيتكوين

Comments

Post a Comment