According to market analysts, the first launch of Ethereum investment ETFs could begin by mid-June.

The newly approved funds aim to expand the scope of investments in Ethereum by enabling trading of shares on exchanges, mirroring the cryptocurrency's price movements.

Analysts expect Ethereum ETFs to debut by mid-June

Eight ETF applicants, including VanEck, BlackRock and Fidelity, received regulatory approval on May 23. Hashdex was the only source that did not get the green light that day. However, approval does not mean that the instruments will be available on exchanges tomorrow: applicants must obtain approved S-1 registration data before trading begins.

And he emphasizes James Seyphart The Bloomberg analyst indicated that this process could take a few weeks or even five months. To wait for Another Bloomberg analyst, Eric Balchunas, announced its launch in mid-June.

“My guess is there was only one round of comments on the S-1s and during BTC one round lasted about two weeks. So as of mid-June it's definitely a guess, but we'll see." said Balchunas.

Read more: What is the meaning of the Securities Commission's decision regarding Ethereum funds?

quickly Submitted The revised VanEck S-1 is awaiting 19b-4 approval, and other applicants are expected to follow. Noted Gabriel Shapiro From Delphi Labs, the SEC approval came from the Trading and Markets unit. The SEC Commissioner can appeal this decision within ten days.

Expectations for Ethereum spot ETFs are high. Seyffart predicts it could attract 20% of one-time Bitcoin ETF inflows, while Balchunas estimates a conservative figure of 10-15%. Since their launch, spot Bitcoin ETFs have accumulated $13.3 billion in net inflows. A 20% takeover means spot ETH ETFs could see inflows of around $2.66 billion.

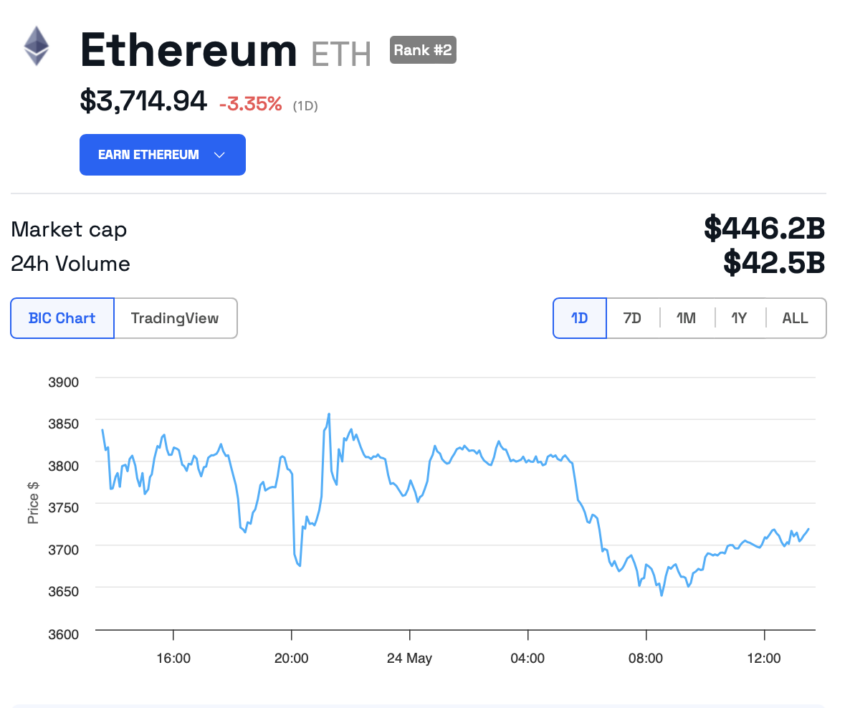

However, the dynamics of the second most capitalized cryptocurrency is still far from being on the rise. After the SEC's decision, the price of Ethereum only increased by 1%. At the time of approval, ETH was trading at $3,840. According to BeInCrypto, it has since fallen 3.5% to $3,714.

Learn more: Ethereum Price Forecast in 2024

This situation embodies the phenomenon ofSell newsThe price of Ethereum rose 10% minutes after rumors of an imminent ETF approval began circulating. Now that the news has been confirmed, the market has started to sell off.

Bitcoin had a similar response when spot Bitcoin ETFs were approved in January. It took a full month of volatility before BTC returned to its pre-approval price. Once I did that, I reached a new all-time high.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, action or decision taken by the reader in accordance with this information is solely the responsibility of it and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,أخبار الإيثيريوم (ETH),أخبار صناديق الاستثمار المتداولة

Comments

Post a Comment