revealed Recent filings with the U.S. Securities and Exchange Commission (SEC) on Form 13F indicate that several major Wall Street firms and U.S. banks have begun purchasing Bitcoin ETFs. These revelations also highlight the growing institutional interest in Bitcoin. Which can have major implications on the acceptance and valuation of cryptocurrencies.

Julian Fahrer, CEO of Bitcoin-focused app Apollo Sats, also highlighted the importance of these revelations. Explained in Tweeter On Twitter: “BREAKING: SEC Form 13F Filings Show US Banks Buying Bitcoin. »

US banks and Wall Street buy Bitcoin ETFs

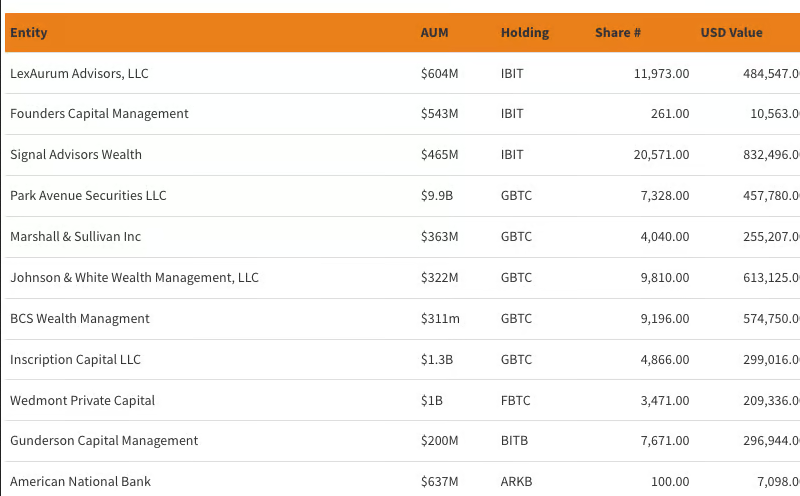

Faher noted that these deposits include purchases from a group of investment managers and family offices. Which has assets under management ranging from $200 million to $10 billion. This indicates an expansion of the institutional acceptance base of the currency.

He notably highlighted American National Bank's investment in the Ark ETF. It is “important to break the seal imposed on banks that buy ETFs”.

The second largest name on the list is Park Avenue Securities LLC, with $9.9 billion in assets under management, which purchased 7,328 shares of GBTC worth $457,780.

In total, Wall Street firms bought assets Combined value of $15 billion Bitcoin futures exposure of approximately $4 million in Q1.

Matt Hougan, Chief Investment Officer at Bitwise. interpret The importance of these revelations, he tweeted: "For anyone wondering 'who buys Bitcoin ETFs?' », I would like to circle May 15 on your calendar.

He explained that investors who manage more than $100 million are required to file Forms 13F with the SEC. This ensures periodic transparency of their holdings of public shares.

More names and companies

Although these repositories only provide a snapshot. "Some of the names in these documents will surprise people (in a positive way)," Hogan said.

A famous cryptocurrency analyst also participated MacroScope In his opinion, noting that the most interesting names might only appear in the May files. Some funds delay disclosure in order to maintain strategic secrecy for as long as possible.

Read also: BlackRock CEO surprised by Bitcoin rise and Ethereum ETF optimism

He specifies: “These deposits begin in April and continue until May. (...) In my experience, the most interesting names can arrive in May. Some funds wait as long as possible so as not to reveal their hand before the required deadline. .”

This is a trend where large institutions are constantly increasing their stakes in Bitcoin through ETFs. This confirms a turning point in how giant investment financial institutions view the leading digital currency, and therefore the digital currency market as a whole.

These investments reflect growing confidence in their long-term value as an asset class. Upcoming first-quarter filings, expected by May 15, are expected to provide more information on this evolving trend. Wall Street appears increasingly comfortable integrating Bitcoin into its investment portfolios.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,العملات الرقمية,صناديق ETF

Comments

Post a Comment