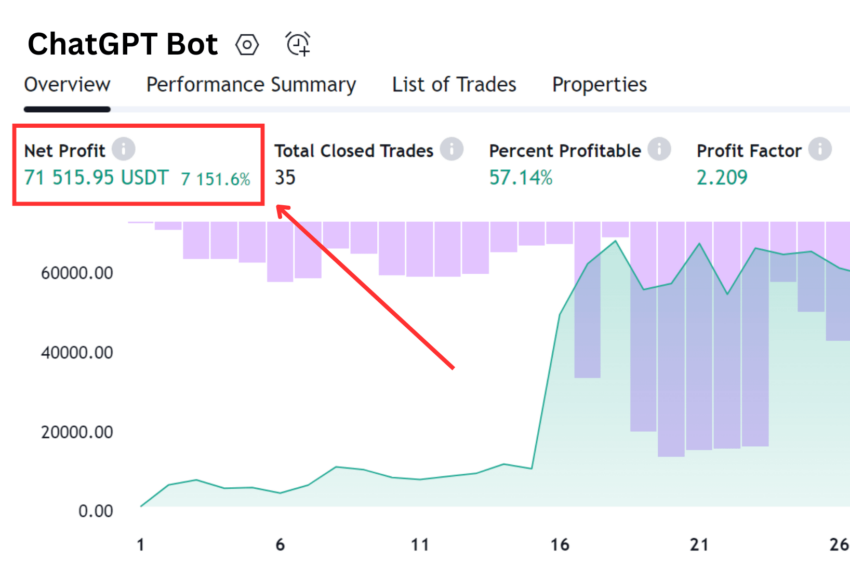

In the current dynamic market scenario, artificial intelligence (AI) is transforming various industries, including cryptocurrency trading. One notable example is Rekt Fencer, a pseudonymous investor on X (formerly Twitter), who claims to have made a whopping $71,500 profit using an AI-powered trading bot.

This case highlights the growing role of artificial intelligence in automating complex business processes.

How Rekt Fencer Created a Cryptocurrency Trading Bot with Help from ChatGPT

Rekt Fencer has developed a robot Trading with the help of ChatGPT Using the Bollinger Band Indicator. Some traders use this indicator for its effectiveness in analyzing market trends.

His strategy was to buy when the price rose above the Bollinger band and sell when it fell below it. This tactic takes advantage of market volatility, allowing traders to predict potential price movements based on statistical data.

Learn more: Discover the best trading robot to make profits on digital currencies

Rekt Fencer described a process that others can replicate, highlighting the ability of artificial intelligence to automate trade.

Initially, Fencer changed the Bollinger band settings on TradingView, an analytical platform popular among traders. He then walked users through the robot's coding, including several upgrades aimed at improving its ability to adapt to changing market conditions. Integrating the bot with ChatGPT was crucial to improving the trading algorithm.

The next steps included duplicating the indicator source code, renaming it, and making necessary upgrades. Finally, the business logic was written into the system.

"Code strategy entries for this in Pinescript v5. Enter a buy trade when the price closes above the Bollinger band and sell when the price closes below the lower Bollinger band. Close the buy when the sell condition is met and close short when the Bollinger Band is long the condition is met,” partner Rekt Fencer ChatGPT router.

Fencer pasted the source code below the claim to instruct ChatGPT to write logic that automates the transaction entry and exit processes.

The duelist also highlighted the importance of resolving coding errors, a typical challenge in programming. After pasting the entry and exit logic on TradingView, he also recommended using ChatGPT to effectively diagnose and debug errors.

He also warned of the risks involved in trading. The fencer advised starting with smaller amounts to assess the effectiveness of the strategy before increasing the risks.

This cautious approach highlights the need for risk management, particularly when using automated systems capable of executing trades independently.

Users need to link their cryptocurrency exchange accounts to TradingView to automate the entire trading process. This integration allows the robot to make trades directly based on the configured strategy.

Although AI-based trading robots like Fencer offer promising profit opportunities, they require a thorough understanding of the technology and market principles. As technology develops artificial intelligence, its ability to improve trading strategies increases, providing traders with advanced tools to improve their performance in the market.

However, successful trading always depends on careful strategic planning and strict risk management.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

التكنولوجيا,العملات الرقمية,العملات المشفرة

Comments

Post a Comment