The cryptocurrency market recently saw Bitcoin halve in 2024. An event that significantly halves the Bitcoin mining reward, in an attempt to limit new supply.

This crucial event, the fourth since the creation of Bitcoin, has sparked much discussion about its implications for miners, investors and the broader market landscape.

Bitcoin miner upgrade

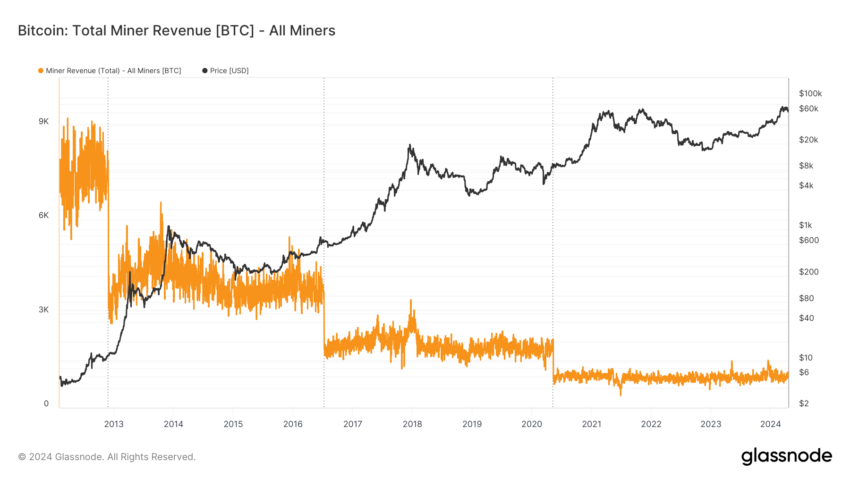

With the block reward halving from 6.25 BTC to 3.12 BTC, miners initially faced significant challenges. Omar Lopez, founder of Cripto It Club, shared with BeInCrypto that a portion of miners will have to stop their operations as it becomes economically unviable to continue. Some will even find themselves operating at a loss.

This scenario embodies a form of game theory, according to Lopez. Initially, if 1,000 miners profitably mine 6.25 BTC, the profitability equation changes drastically after the close when the reward drops to 3.12. BTC, distributed among the same number of minors. This change forces miners who cannot bear the losses to stop their operations.

Ultimately, this attrition could eventually reduce the number of minerals to, say, 600. For these remaining miners, reduced competition could result in 3.12 BTC Restore profitability, leading to the stabilization of the mining landscape.

“Miners follow the price of Bitcoin, not the other way around. If the price of Bitcoin is low and mining is not profitable, many miners will shut down their machines until it becomes profitable for those remaining to compete for the 3.12 Bitcoins game. theory in all its splendor. Lopez explained.

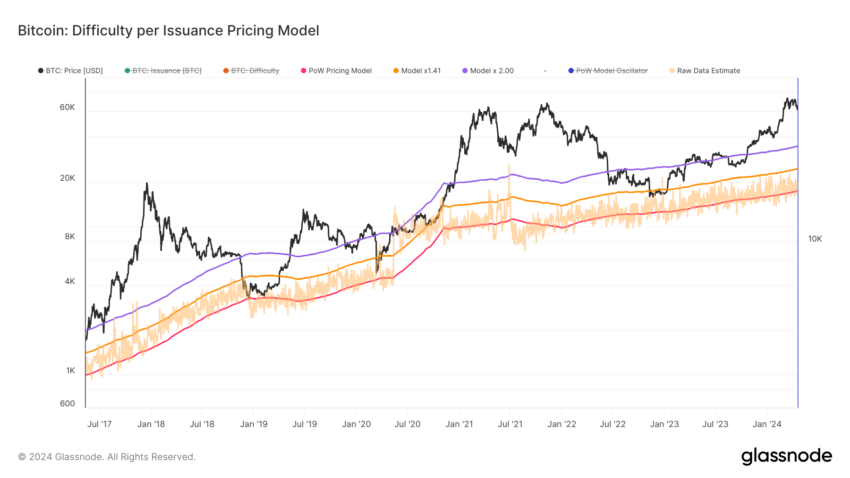

For this reason, some Bitcoin mining companies are increasingly investing in the latest technologies. Hao Yang, head of financial products at Bybit, highlights the strategic shift towards more advanced mining solutions.

Many miners are upgrading their equipment to newer models that provide more mining power while reducing energy consumption. This strategy generally works for more professional Bitcoin miners who have the necessary capital.

By doing so, they are able to improve their profitability, especially during the difficult first days following the Bitcoin halving.

“Miners are focusing on energy efficiency and diversification by investing in next-generation equipment such as triple-nanometer mining rigs, which can increase the hash rate to 3.4 exahashes per second, increasing capacity without a proportional increase in energy consumption,” Yang told BeInCrypto. .

This upgrade not only contributes to the sustainability of operations, but also contributes to the overall efficiency of the mining process. Thus, this ensures that miners remain competitive after the mining process.

Read more: What is the future of Bitcoin after mining? Is the story over?

With a focus on sustainability, mining companies are adopting energy-efficient technologies and integrating their operations into broader energy systems. This approach includes exploring renewable energy sources such as solar and wind power, and even recovering energy from waste.

These options have become popular for reducing the environmental impact of mining operations.

Growing demand for Bitcoin

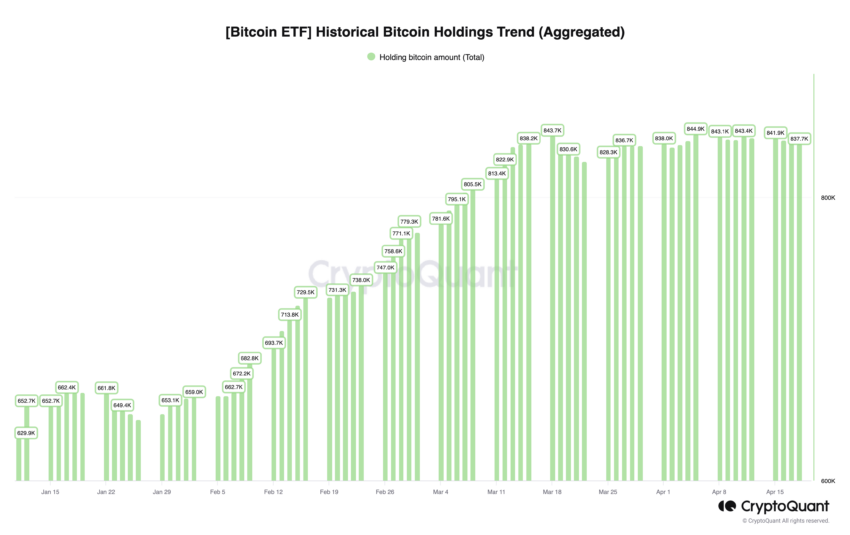

Additionally, Yang notes that significant changes have occurred in the structure of the Bitcoin market, particularly with the introduction of Bitcoin exchange-traded funds (ETFs). These funds played a crucial role in integrating Bitcoin into traditional financial markets.

“Exchange-traded funds provide an important means by which traditional investors can use Bitcoin as a portfolio diversification tool in a structured and familiar way. In this sense, these financial instruments have proven that Bitcoin is here to stay, that it will not. go to zero, and that it can play a role in... "And you will play a role in our future financial system."

This merger not only stabilized price fluctuations, but also established Bitcoin's permanent presence in the financial system. This also opened the door wide to meet the growing demand from institutional investors. In total, spot Bitcoin ETFs now hold over 837,700 BTC, worth $53.61 billion.

According to Maurizio Di Bartolomeo, co-founder of Leiden, this has significantly improved market liquidity.

“This is the first halving in which spot Bitcoin ETFs hit the market, unleashing a torrent of institutional demand. So far, the conditions appear to be ripe for this halving to have a similar impact on prices. on prices,” Di Bartolomeo told BeInCrypto.

Although immediate price increases after a halving are not always clear, the general consensus is that halvings will have a positive impact on the value of Bitcoin in the long term, as has been the case historically.

During the first Bitcoin halving, which took place on November 28, 2012, the price of Bitcoin reached $12 and then rose to $1,242, representing a staggering increase of 9,937%. The second halving, which took place on July 16, 2016, began with Bitcoin initially trading at $664, eventually reaching $19,804, reflecting a 2,903% rise. The last halving, on May 11, 2020, saw the price of Bitcoin rise to $8,571, later peaking at $68,997, an increase of 705%.

“Historically, price action has been quite muted around the halving itself, but there was a significant price rise 9-12 months later, this was apparently due to Bitcoin miners were earning smaller amounts of Bitcoin to sell in the market, relative to the demand for Bitcoin. and as such, the halving was a “buy on the news” event, Loka Mining CEO Andy Vagar Handica told BeInCrypto.

Read more: Cryptocurrency prices fall before halving: who brings the market down each time?

As Bitcoin evolves post-halving, the introduction of new, more energy-efficient mining techniques and strategies will likely continue to shape the industry. These developments are essential to maintaining the long-term stability and sustainability of the Bitcoin network, strengthening its position as an essential component of the future financial system.

With each Bitcoin halving, Bitcoin moves closer to its eventual maximum supply, highlighting its unique business model and its ability to continue to influence the global financial system.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,أخبار البيتكوين (BTC)

Comments

Post a Comment