Researcher and financial markets expert Jim Bianco has criticized spot Bitcoin ETFs which in recent months have dominated all the attention in the digital currency market. Warning of the potential risks this may present. Bianco highlighted the implications of these funds for the market, citing specific concerns about investor behavior.

By analyzing data and comparing the distribution of investments in Bitcoin ETFs versus other investment funds such as gold and blue-chip stocks, Bianco reveals an investment pattern that could have major implications for the cryptocurrency market.

Absence of large investors in Bitcoin ETFs?

He explained Bianco said that AIs, despite owning about 35% of all ETFs, only own less than 1% of Bitcoin spot funds.

According to Bianco, this calls into question the validity of the prevailing belief that “The arrival of large investors to invest In these boxes.

Bianco likened Bitcoin spot ETFs to “orange FOMO poker chips” that primarily attract small traders who can sell their holdings quickly.

In poker, orange chips are generally used to represent low or medium bets.

He pointed out that these traders could be approaching break-even, which could prompt them to sell and create significant selling pressure on the world's largest cryptocurrency.

The expert cited a study conducted by Citibank that showed that investment advisors own only a small portion of new Bitcoin investment funds,

While their holdings in non-stock mutual funds such as Gold (GLD) and Big Tech (TLT) are much higher, at 22% and 40% respectively. Bianco's analysis suggests that wealth managers' holdings in Bitcoin ETFs are negligible.

Selling pressure is imminent

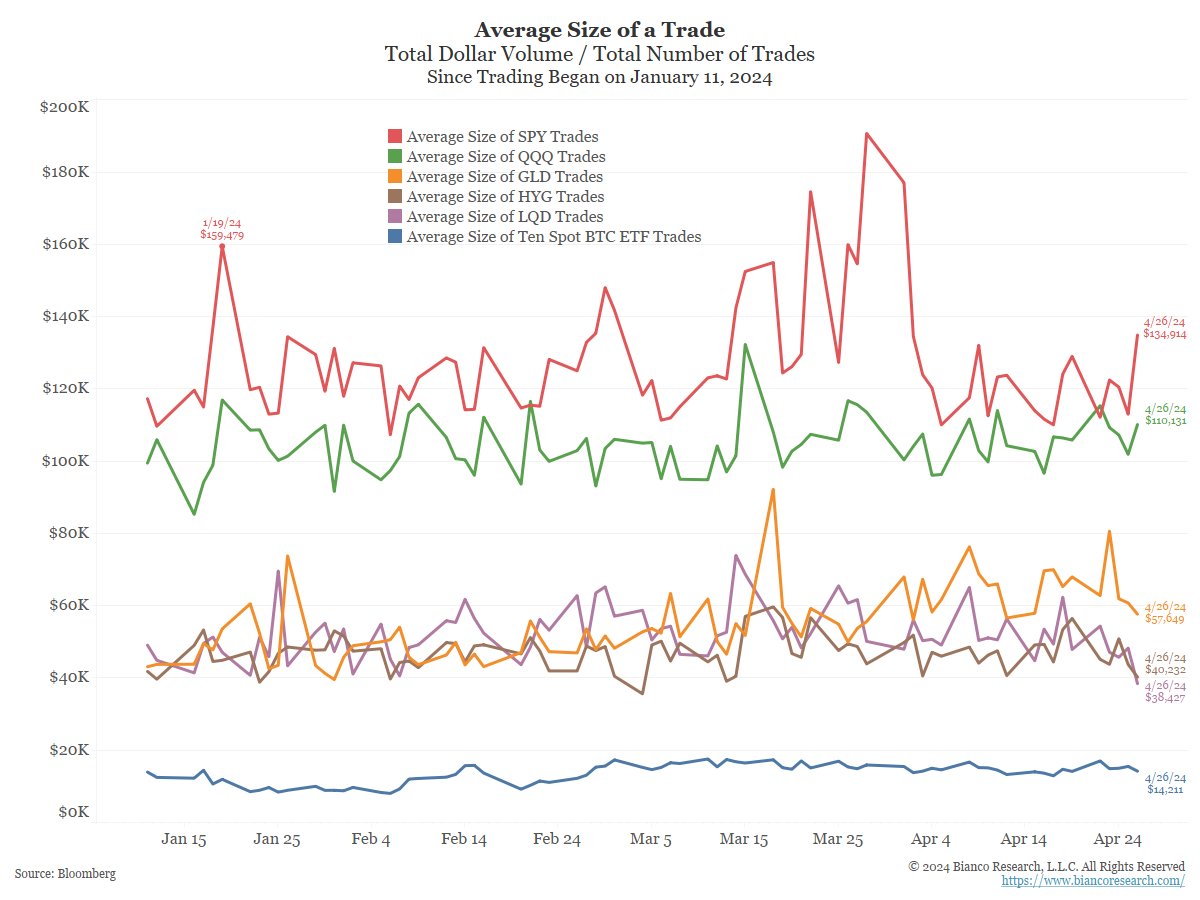

Bianco also highlighted the average trading volume of Bitcoin ETF buyers, particularly retail investors. His observations indicate that the average trading volume of Bitcoin fund shares is remarkably low. This is only about $14,000, less than half the average trading volume of the next financial asset in the ranking.

This means that the trading volume in these funds is often very low compared to trading in other assets.

This trend suggests that a significant portion of Bitcoin ETF shareholders are retail investors who may have a greater propensity for short-term speculative strategies.

The fear is that these investors, known as “reckless retail traders,” are more likely to sell at the first sign of trouble, especially if Bitcoin falls below their average purchase price of $58,000.

Potential catastrophic scenario

Bianco highlighted the potential repercussions if Bitcoin trades below $58,000. Explaining that historical data shows a trend among traditional speculators to sell.

Importantly, as the price of Bitcoin approaches the average purchase price for these investors, net flows into spot Bitcoin ETFs – with the exception of Grayscale's Bitcoin ETF (GBTC) – begin to move towards Exits.

Bianco likened this scenario to a wildfire in which Bitcoin is sold fiercely when the price falls below the average bid price. Which could lead to disruptions in the markets.

Although Bianco recognizes the benefits of Bitcoin investment funds as part of the overall landscape of the digital crypto financial services industry. He warns of the risk of this becoming a speculative tool that hinders the main goal of building a strong digital financial system.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,الأسواق,تحليلات,العملات الرقمية,بت كوين,بيتكوين,صناديق ETF

Comments

Post a Comment