Currently, traditional assets are constantly declining due to overproduction and inflation. Bitcoin stands out as a beacon of stability thanks to its consistent scarcity and superior monetary properties.

As the next Bitcoin halving approaches, experts and market analysts point out that Bitcoin is the ultimate tool for saving money in the long term.

Bitcoin: the ultimate savings tool

According to Report Bitcoin's unique new features put it ahead of traditional savings instruments. The upcoming Bitcoin halving, which will reduce the block reward from 6.25 BTC to 3.125 BTC, is expected to solidify Bitcoin's role as a major savings vehicle, explained Joe Burnett, researcher at Unchained.

Burnett described the modern economic environment as an “innovation trap.” Here, rapid technological advancements and market competition increase the supply of goods and services. Which ultimately leads to a decline in asset values.

He argued that in such a scenario, storing significant wealth outside of Bitcoin would be “increasingly difficult” due to the decline in the value of traditional assets.

“Bitcoin could be the asset class that increasingly represents a significant portion of total global wealth, at a time when global wealth is growing rapidly due to the continued acceleration of innovation in a world of abundance, hyperproductivity and extremely competitive markets. , storing significant wealth outside of Bitcoin will be “increasingly difficult”.

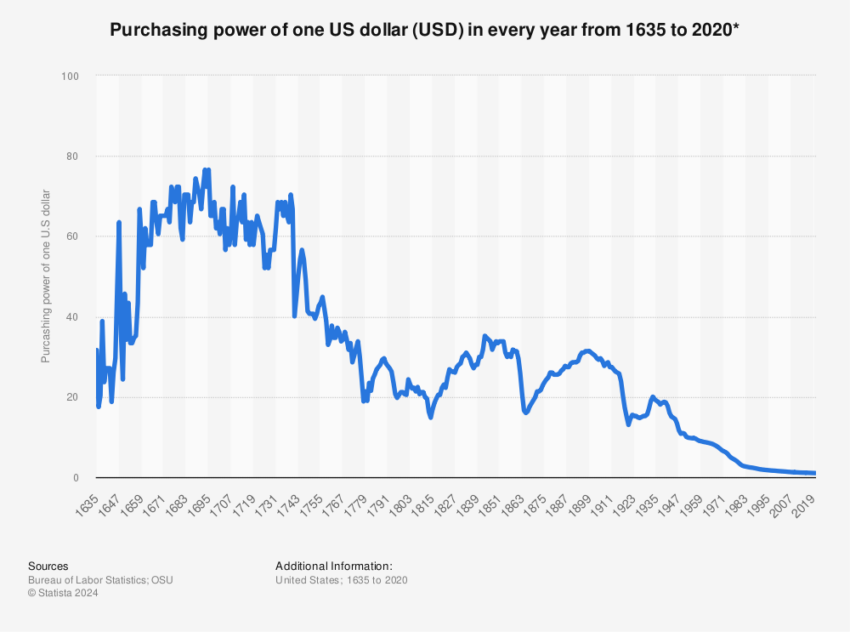

The researcher also pointed out that traditional assets. Including paper currencies, stocks and real estate, their value is subject to erosion over time. For example, the US dollar has depreciated dramatically, losing 92.8% of its value over the past five years against consumer staples.

Read more: How to protect yourself from inflation with cryptocurrencies?

This trend is reflected in other asset classes, with 20-year Treasuries falling more than 94.8% during the same period.

Even precious metals like gold and silver are not immune. Despite their historical reputation as a stable store of value, increasing efficiency in mining and production techniques has led to oversupply, causing their value to decline.

“There is a virtually infinite amount of gold in the universe, and the value of gold is estimated at $771 trillion in Earth's oceans alone (about 70 times the current circulating supply. Burnett explained that the potential supply of gold in circulation has no serious limit). , and the value will decrease. The economies of gold holders are infinite as humanity's productivity in gold mining and mining increases.

These results highlight the diminishing returns of traditional investments and highlight the growing importance of Bitcoin. Burnett argued that Bitcoin’s “absolute and immutable scarcity” makes it particularly suitable as a savings instrument, especially in a highly competitive and innovation-driven economy.

Effects of Halving on Bitcoin

As the halving approaches, reducing Bitcoin's supply inflation by 50%, Burnett noted that this would reduce selling pressure and could lead to a significant price rise.

Similarly, Matthew Howells Barbee, vice president of growth at Kraken, noted that Bitcoin halvings have historically caused significant price increases. All-time highs are typically reached within a year of previous halving events.

“The Bitcoin halving has long been a stepping stone to new price discovery for Bitcoin. All-time highs were reached in the year following each of the last three halving events, eclipsing any gains made in the year before the halving. .

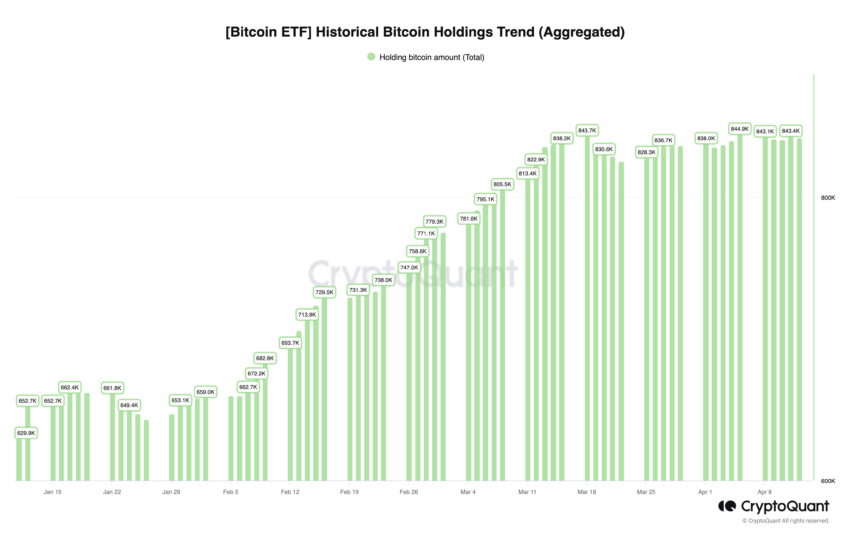

He also explained that the influx of spot Bitcoin exchange-traded funds (ETFs) likely accelerated the rise in Bitcoin's value more than expected. Thus, this paves the way for another bullish cycle after the close.

Price predictions place Bitcoin between $100,000 and $120,000 in the current bull market. Instead Expectations The most optimistic long-term outlook from analysts like Cathie Wood predicts Bitcoin will reach $1.48 million by 2030. For this reason, the case for Bitcoin as a superior savings instrument is compelling.

“One of the most important differences of this cycle compared to previous cycles is the composition of investors. Spot Bitcoin ETFs have brought in a much larger volume of institutional capital, which should theoretically reduce Bitcoin price volatility over a longer period of time. » Howells-Barbe concluded: “I still think we will face bearish market conditions going forward, but the upside potential is greater,” he said.

The argument for Bitcoin's superiority lies in its performance and the technology behind it. It guarantees that no more Bitcoin can be created beyond its cap of 21 million BTC. This aspect of Bitcoin gains particular importance as the halving date approaches, highlighting its resilience to inflation and its ability to protect against economic uncertainty.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,البيتكوين,العملات الرقمية,العملات المشفرة

Comments

Post a Comment