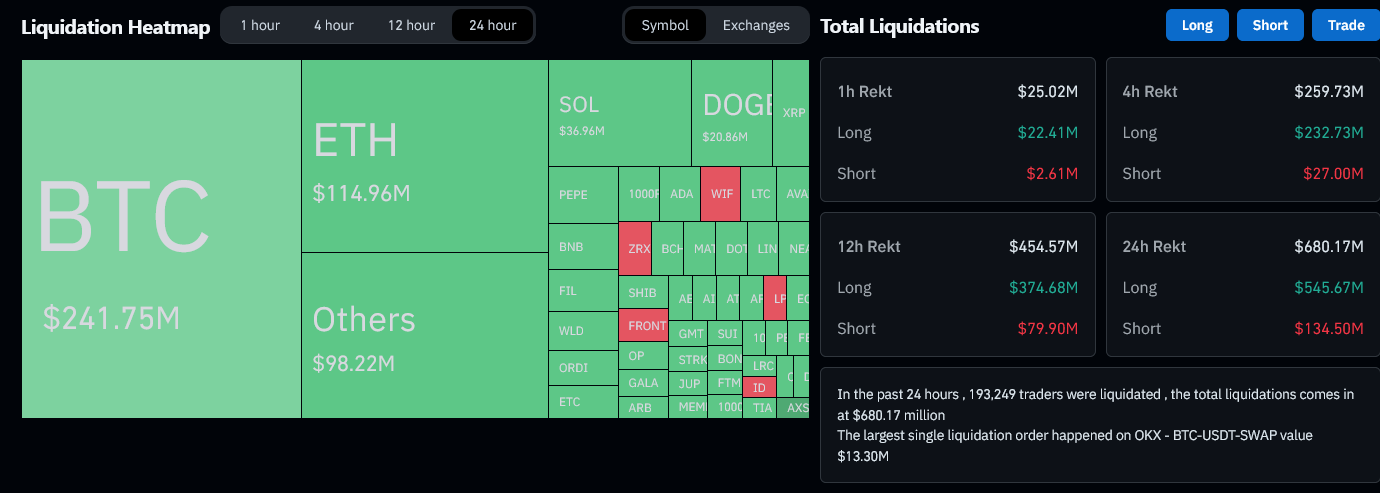

I witnessed Digital Currency Market has significantly decreased Bitcoin BTC Price By 9.5% in a matter of hours on Friday, March 15, leading to the liquidation of large futures market positions worth over $680 million by over 193,000 traders.

Bitcoin price hit a new all-time high at $73,835 on Thursday, March 14, but quickly retreated to $66,800.

Other assets such as gold and Wall Street's Nasdaq technology index have also been under pressure this week.

She emphasized data CoinGlass reported that the majority of liquidations involved long positions (which bet on the price rising) amounting to $545 million, while liquidations of short positions (which bet on the price falling) accounted for a larger percentage. low, amounting to $135 million.

Analysis of the reasons for the fall in the price of Bitcoin

Analysts view Bitcoin's pullback from its all-time highs as a typical breakout for bulls after strong uptrends.

Experts and analysts have attributed the decline of digital currencies to several factors, including the decline in momentum of digital currency exchange-traded funds (ETFs), which have seen a decline in the volume of investments entering them by 48% compared to to their 14-day average. .

And according to For the data According to Farside Investors, Bitcoin spot ETF inflows totaled just $133 million on March 14, the lowest level this month.

Analysts also highlighted the impact of US economic data released this week, as shown Producer price index (PPI) rose more than expected, reinforcing expectations of continued interest rate hikes by the US Federal Reserve.

In addition, the rise in the Consumer Price Index (CPI) at the start of the week helped to heighten concerns about the US economy.

The decline in Asian stock markets on Friday was consistent with fears of US monetary tightening. US economic data dampened hopes of an imminent interest rate cut.

“Recent strong U.S. CPI readings have dampened expectations of interest rate cuts by the Fed and gold prices have also fallen,” said Greta Yuan, head of research at VDX, an exchange approved in Hong Kong. fast. » Too much for the market to properly price, so a current correction is expected. »

Future prospects

Some analysts expect a further decline that could take the price of Bitcoin to between $63,000 and $64,000. But it will be temporary and short-lived, and is part of the normal correction.

Traditional fundamental analysis indicates that the current price rise is “only the beginning of a longer upward trajectory.”

Due to the massive inflows seen by Bitcoin ETFs and Michael Saylor's continued buying from... Microstrategy MicroStrategy for more Bitcoin.

“Multi-billion dollar net inflows (into Bitcoin spot ETFs) in just two months have irreversibly changed the landscape,” they claim.

“It is very difficult for such short selling to have a permanent impact on the uptrend. As long as the demand for spot Bitcoin ETFs remains strong,” QCP Capital said in a note published on Telegram on Friday morning.

She added that some fluctuations are expected over the weekend. As the market prepares to release the Federal Open Market Committee minutes next week.

BTC Price Correction Technical Signal

Yesterday he stressed a report BeInCrypto reported that a bullish wedge reversal technical pattern has formed on the 4-hour chart. For the price of Bitcoin BTC. It appears that this model was made, as shown in the attached diagram.

Looking at the Fibonacci retracement levels, the price broke above the support level of $68,800 (23.60%). The next support level is at $65,670.

The fundamental outlook remains bullish and support levels could represent good buying areas. But you need to be careful if you trade with leverage. The price fluctuation will be very strong, and therefore the risks high.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,الأسواق,تحليلات,تحليلات تقنية,العملات الرقمية,العملات المشفرة,بيتكوين

Comments

Post a Comment