Solana (SOL) price saw a significant rise, hitting a new multi-year high of $173. Thus, the altcoin broke through several resistance levels.

However, from now on you will notice GROUND More increases and profits for its investors, or is this the end of the upward trajectory?

Solana is very rewarding

Solana’s price surge since late February has seen the altcoin rise by 70%. Current market conditions suggest that SOL is not too late to be eligible for investment and can still generate significant profits.

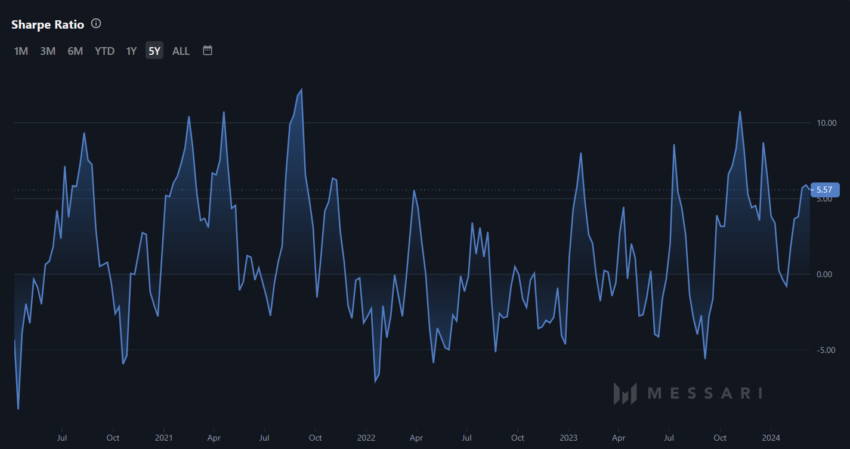

The asset's Sharpe ratio currently stands at 5.37, the highest seen since December 2023. The Sharpe ratio measures the risk-adjusted return of a cryptocurrency investment or portfolio. It compares a cryptocurrency's excess return (above its risk-free rate) to its volatility.

A higher Sharpe ratio indicates better risk-adjusted returns, which indicates that the investment provides a higher return for the amount of risk taken. However, market volatility must also be considered in addition to the Sharpe ratio.

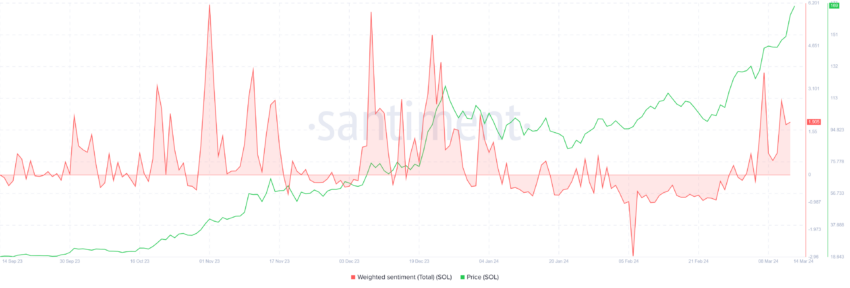

However, the growing market dynamics are in line with the rewards. Investors are optimistic about making further gains, as the chart shows. The weighted sentiment index increases when the volume of social exchanges is high, and the vast majority of messages in it are at the same time very positive.

Therefore, given that all indicators are trending upward, the chances of this happening seem high.

SOL Price Prediction: Road to $200

Solana price, which is trading at $170, is on the verge of crossing the $200 level, having already broken through these resistance levels. The altcoin is on the verge of crossing the 50% Fibonacci retracement level from $248 to $89. This level represents a decisive bullish reversal towards price action.

Once this line hits a support floor, SOL will have the bullish momentum to continue rising.

However, if the breakout fails, Solana price could fall and reverse the trend. As is the case with the Relative Strength Index (RSI), it is in the overbought zone.

This indicator is a momentum oscillator that measures the speed and variability of price movements. Indicates overbought or oversold conditions for an asset. High RSI values indicate overbought conditions, while low values indicate oversold conditions, which can indicate price reversals.

Since the RSI is rising at the moment, investors should be careful as Solana is on the verge of a price correction. If the “Ethereum Killer” fails to move $168 to the support level, Solana will likely correct and drop to $150, invalidating the bullish thesis.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, action or decision taken by the reader in accordance with this information is solely the responsibility of it and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة

Comments

Post a Comment