Litecoin (LTC) Price Rises 11% in Three Days, But Is There Still Room for Growth? Technical indicators indicate this. The currency's RSI remains in good shape, indicating that there is still room for bulls to push prices higher.

The number of short-term traders holding the currency increases LTC regularly, which could lead to further price fluctuations in the future. These short-term traders are known for entering and exiting trades quickly, which can lead to wild price swings.

Litecoin RSI Remains in Good Shape Despite Recent Price Growth

Litecoin's Relative Strength Index (RSI) has shown a significant increase over the past two weeks, rising from 60 to its current level of 67. The Relative Strength Index (RSI) is a valuable tool for measuring strength relative of an asset and identify potential turning points.

The Relative Strength Index reflects the overall dynamics behind price movements by comparing the magnitude of recent gains with recent losses. This indicator ranges from 0 to 100, with values above 70 generally considered an indication of overbought conditions, which may herald a price correction. Conversely, values below 30 indicate that an oversold asset may be ready to rebound.

This recent rise in LTC's RSI shows an increase in buying pressure, highlighting increased investor interest and a more active market. Although the current reading of 67 is in a healthy zone, it is important to note that it is approaching overbought territory.

- For the latest Litecoin (LTC) price analysis from BeInCrypto,click here>

This suggests that a period of consolidation, or even a potential decline, could be on the horizon as some investors choose to take profits. However, it is still too early to conclusively predict a reversal, and the RSI itself does not provide a guaranteed roadmap for future price movements.

Traders continue to grow

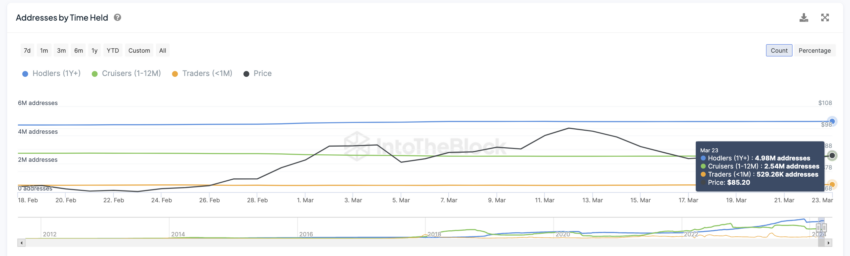

A deeper analysis of LTC holder trends reveals a continued increase in the number of coin holders in the short term. The number of these traders, who have owned LTC for less than a month, increased from 429,000 to 529,000 between February 18 and March 25.

However, this increase in short-term ownership comes with a potential downside. Medium-term owners, or “fliers” as they are called (those who hold more than a month and less than a year), are showing signs of decline. This category increased from 2.74 million to 2.54 million during the same period.

This shift towards short-term traders and abandonment of long-term “believers” can have a double impact on... LTC Price. Increased volatility is a possible outcome. Short-term traders are known for rapid buying and selling, which can lead to price fluctuations.

LTC Price Prediction: EMA Lines Just Formed a Golden Cross

The recent surge in LTC prices may be just the beginning. The short-term exponential moving average (EMA) lines have recently broken above the long-term EMA lines. This is called the Golden Cross. This is a bullish formation, indicating that a new bullish wave may begin soon.

Exponential moving averages (EMA) are technical analysis indicators used to understand price trends and potential turning points in an asset's value. Unlike the simple moving average (SMA) which gives equal weight to all prices over a period of time, exponential moving averages focus more on recent price levels. This weighting system allows exponential moving averages to react more quickly to market changes and identify trends more accurately.

A bullish crossover occurs when the short-term EMA rises above the long-term EMA. While a bearish crossover is the opposite.

Read more: Trading strategies in an uptrend or how to buy cryptocurrencies in the event of an increase?

Given the influx of short-term traders and the favorable EMA position, a return to $105 for LTC would not be surprising. If this happens, LTC could continue to rise and reach $115 next week. This would mark Litecoin's highest price since April 2022. However, a break from the stable support levels at $83 could lead to a further decline towards $72.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, action or decision taken by the reader in accordance with this information is solely the responsibility of it and its affiliates individually, and the site assumes no legal responsibility for such decisions.

تحليلات,العملات الرقمية,العملات المشفرة,سعر لايتكوين

Comments

Post a Comment