Ethereum (ETH) has shown tremendous strength recently, with its price steadily increasing. Channel data You paint A promising image, which indicates an upward trend that could lead the price of Ethereum to reach a new all-time high.

On the other hand, other measurements show that a correction can occur sooner if the support zone is not strong enough. Will ETH continue its upward trend or is a correction imminent?

Ethereum RSI is rising rapidly

Over the past month he has witnessed Relative Strength Index (RSI).) Ethereum saw a significant increase from 73 to 82. This rise in RSI is an indication that Ethereum is witnessing... Strong buying pressure. Traditionally, an RSI value above 70 indicates that the asset may be overbought, which can be an indicator of a potential pullback as the market seeks to correct and find equilibrium. Although a rise in the RSI is not always a reliable warning sign of a pullback.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and variability of price movements. The RSI oscillates between zero and 100 and is generally used to identify overbought or oversold conditions in a trading asset.

A high RSI value calls for caution, but it is not always a guaranteed signal of falling prices. Historically, Ethereum prices have risen despite the rising RSI, defying expected market corrections.

NUPL Unrealized Net Gain/Loss Index Increases Rapidly in a Week

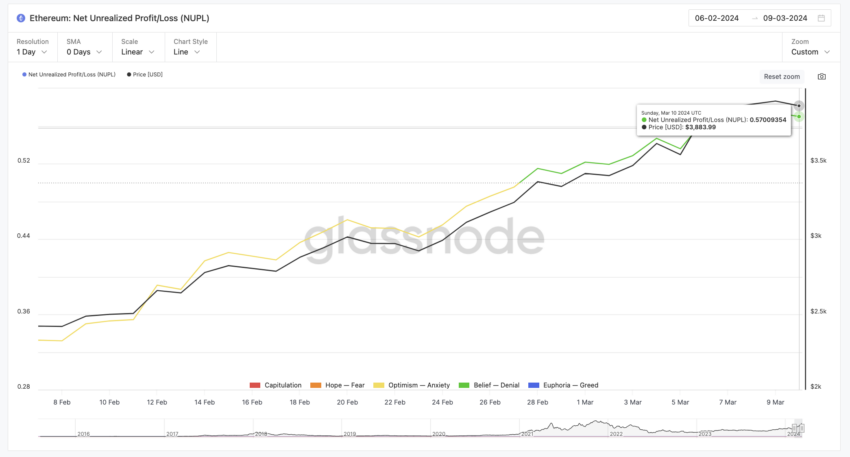

Between February 27 and 28, the Ethereum Net Unrealized Profit/Loss (NUPL) indicator moved from the “Optimism – Concern” phase to the “Belief – Denial” phase. This change indicates that most ETH holders are now reaping profits. This generally indicates that a bull market is gaining momentum, with investors maintaining strong confidence in their assets without excessive behavior.

The NUPL Net Unrealized Gain/Loss Index is a metric that calculates the difference between unrealized gains and losses across all entities in the chain. This is a measure of whether network participants are mostly in a winning or losing state at the current time. The scale reached a state of "denial of belief", increasing from 0.51 on February 28 to 0.57 on March 10, and became stable between March 6 and 10.

The NUPL scale has been growing rapidly, meaning its status may soon move from the “Belief – Denial” category to the “Ecstasy – Greed” category. This may indicate an overly optimistic market, with most investors taking advantage of profits. Historically, this sentiment has been an indicator of a market peak, which can lead to a market correction as more investors tend to take profits.

ETH Price Prediction: Could It Hit $5,000?

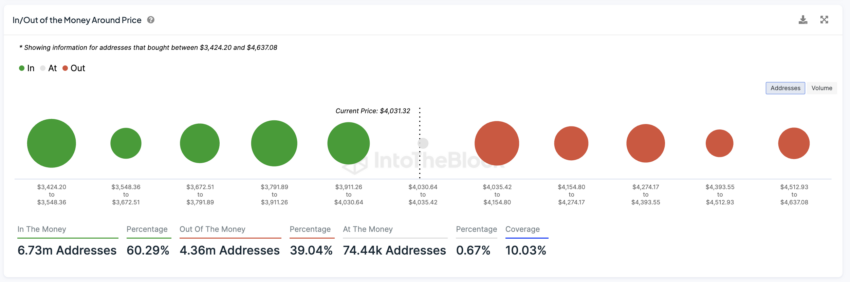

Ethereum price is still 17% lower than Its highest level ever reached At $4,867.17, which it reached on November 10, 2021. Prices between the $3,790 and $3,910 areas may serve as support zones, where the price is likely to stabilize due to concentration coin holders who see their positions still profitable.

Around Money Price Entry/Exit (IOMAP) is a metric that represents where holders are likely to profit or lose. It identifies the prices at which investors purchased different amounts of digital currency and compares them to the current price.

The two highest resistance levels, at $4,035 and $4,274, must be breached to reach a new all-time high for Ethereum. If it succeeds, it could lead to a sharp rise to $4,900 or even $5,000, a new all-time high.

The correlation between Bitcoin and Ethereum prices could also be behind this phenomenon. Given that Bitcoin recently hit a new all-time high, this could also lead to a rise in the price of Ethereum. Other movements can also have a positive impact on Ethereum prices, such as: Approval of Ethereum ETFs Which will certainly happen soon.

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,إيثريوم,العملات الرقمية,العملات المشفرة

Comments

Post a Comment