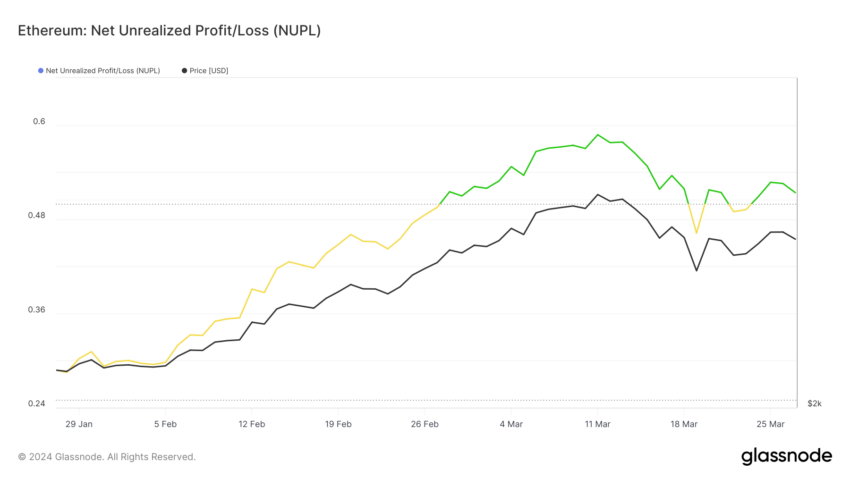

Looking at the upper Bay Cycle indicator, Ethereum price analysis indicates that Ethereum may see further corrections before attempting to reach the $4,000 level again. Moreover, the net unrealized gain/loss (NUPL) indicates that we are still far from euphoric territory. This indicates a potential period of consolidation in the near future.

Additionally, the exponential moving average (EMA) lines reveal that prices are closely converging. This indicates strong support at current levels, which could stabilize Ethereum prices ahead of any significant upward movement.

Ethereum Pi Cycle Shows Important Scenario

Ethereum's trajectory on the Pi Cycle Top indicator indicates a brewing consolidation phase, as evidenced by the two-fold gap between the 111-day moving average and the 350-day moving average.

Currently, the upper limit of the index is set near $4,231, while the lower limit is near $2,750, a difference that allows room for maneuver indicating that the market is stabilizing rather than reaching a summit. It is in this frequency range that the Ethereum price can lay the foundation for its next rise.

The Pi Cycle Top indicator works on the principle that when the price rises above the long-term average (350 days times 2), a market top may be imminent, indicating that the market is overheating and preparing for a decline. When it is below the short-term average, it may indicate that the asset is undervalued.

The price of ETH between these averages and the parallel path of the lines without a crossover event indicates that although the peak of market euphoria has not yet reached its highest levels, the bases are in the process of be discarded for a solid support level. This lack of convergence, combined with current price activity, lends weight to the argument that... ETH It could enter a consolidation phase.

Read more: Everything you need to know about Ethereum funds and altcoin season

ETH is still far from euphoria

Net unrealized gains/losses (NUPL) on Ethereum constantly fluctuate between “optimism-worry” and “belief-denial,” a pattern that indicates market indecision. This rhythmic shift between sentiment zones indicates that investors are alternating between cautious optimism and strong conviction in the asset's potential, but without fully committing to an overall trend. This back-and-forth movement, or “back and forth,” indicates a potential phase of consolidation for Ethereum.

NUPL’s mandate remains “belief denial” to prevent the market from overheating. Sentiment indicates market stability, avoiding massive sell-offs or sell-offs.

This balancing feeling could lead to a steady rise in the price of Ethereum. Without greed or strong fear, a gradual rise is more likely than volatile fluctuations.

Ethereum Price Forecast: Consolidation Before New Highs

Exponential moving average (EMA) lines on a 4-hour price chart provide insight into the price movement of an asset. The exponential moving average (EMA) lines are moving closer together, indicating that there is little volatility and the price is going through a consolidation phase.

Exponential moving averages are a type of moving average that gives more weight to recent prices, making them more responsive to new information. When the EMA lines converge, as they appear on the chart below, it often indicates that there is no strong trend and that prices can move sideways for a while.

The price of ETH oscillates around these lines, indicating a balance between buyers and sellers. Should an uptrend begin, a decisive break above these interlocking EMA lines could push ETH price towards the $4,100 resistance level. An upcoming ETH ETF could contribute to this rise.

If the consolidation phase turns into a downtrend, ETH could fall all the way to the $3,200 support level. A further decline to $2,900 is possible given the broader negative sentiment. Currently, the EMA consolidation lines indicate continued limited trading for Ethereum. Any decisive move outside of this range will likely determine the next major price direction.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any actions, actions or decisions taken by the reader in accordance with this information are solely the responsibility of the reader and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,تحليل الإيثيريوم (ETH)

Comments

Post a Comment