The Cardano (ADA) market is currently experiencing a tug of war between cryptocurrency holders making profits and those making losses, which could lead to a period of stagnation in ADA prices. Since the beginning of March, there has been a significant decline in the number of transactions exceeding $100,000, indicating a slowdown in high-value activity within the ADA ecosystem.

However, the presence of strong support levels can provide a safety net for ADA's valuation, paving the way for the cryptocurrency to begin a new phase of bullish momentum.

Whale Trades Just Broke ADA Price

Over the past three months, a detailed analysis reveals a clear correlation. This correlation exists between high-value Cardano (ADA) transactions and the market price. Specifically, we look at transactions exceeding $100,000.

However, this established trend has recently taken a surprising turn. Over the past few days, Whale trading volume has changed as the price of ADA has increased. From March 6, which recorded 1,192 transactions, to March 14, it fell to 953 transactions. This represents a significant decrease of 20% in just one week.

Monitoring these large-scale transactions provides valuable insights. They are an effective measure for understanding investor behavior in relation to the ADA. Over the last quarter, a clear trend has emerged. As transactions worth more than $100,000 increased, the price of ADA reflected this growth. This trend indicates strong investor confidence associated with trading volumes.

However, this correlation faced a previous divergence in November 2023. Cardano (ADA) prices entered a 15-day stagnation phase during this period. After this lull, there was a notable boom. The price increased by 41% in just five days.

Cardano Battleground Looks Interesting

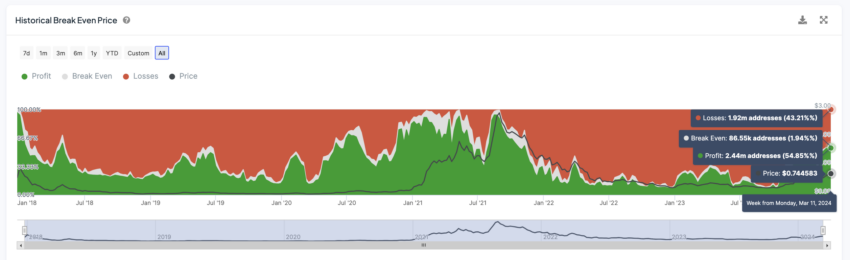

Diving into the current state of ADA through the lens of the stock's profitability provides a fascinating insight. By looking at stocks that are currently profitable versus those that are making profits versus those that are making losses, by looking at ADA Price Currently, we can detect interesting dynamics.

Currently, the majority of ADA holders, or 54.85%, find themselves in the green, benefiting from profitability. In contrast, 43.21% of ADA holders are sailing at a loss, with a slim margin of 1.94% on the verge of break-even.

This scene sets the stage for some compelling interactions. Each faction has an incentive to move the prize to their preferred area. Those who suffer losses may choose to be patient, holding on to their assets in hopes of increasing the value of the ADA to turn around their fortunes. Conversely, those who make profits are encouraged to sell part of their assets, in order to cash in their gains.

However, this novel represents only one of many scenarios that unfold. It is plausible that both winners and losers in this scenario will choose to stand their ground, betting that the value of ADA will increase in the future. If this collective determination continues, we could see a rebound in the price of ADA, illustrating the complex interplay of decisions within the cryptocurrency ecosystem.

Cardano (ADA) Price Forecast: Retest Support Before Targeting $0.84

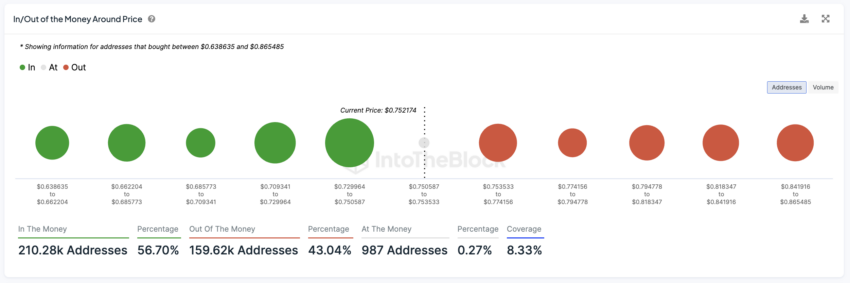

Analysis of the ADA price chart in/out of the monetary range around the price shows that strong support lies around $0.72, followed by another support at $0.70. If ADA cannot withstand these support zones, it could continue to decline towards $0.63.

The IOMAP (In/Out of the Money Around Price) chart is a financial analysis tool primarily used in cryptocurrency markets to visualize price levels at which a significant amount of an asset's supply was previously purchased or sold. This tool compiles large datasets. to show where holders of the asset are likely to incur a profit or loss based on the current price versus the purchase price.

The IOMAP indicator can be useful in identifying support and resistance levels because it highlights price levels at which many investors may decide to buy or sell depending on whether their trades generate a profit (in the money) or a loss (out of the money). ).

This information helps traders and investors make more informed decisions by understanding areas of price consolidation or potential breakout areas.

Cardano does not appear to face strong resistance going forward. The biggest is $0.75. If ADA manages to break it, even if the number of whale trades decreases, it could continue to increase up to $0.84. This would represent growth of 12%.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة,كاردانو

Comments

Post a Comment