According to the analysis to publish In The Scoop, inflows into spot Bitcoin ETFs have a clear impact on the price of the digital currency. However, this is not the only factor that influences its evolution.

He emphasized Analyst Frank Chaparro, cryptocurrency analyst and podcaster. However, his recent comments on Twitter that one-time Bitcoin ETF flows currently represent the primary force shaping the market's trajectory need to be revised.

This is after “further consideration and discussions with some of the best commentators in the market that I follow.”

Chaparro explained that investors who turn to investment funds that track the price of Bitcoin are instead contributing to the rise in its value. Their exit from these funds leads to rapid decline.

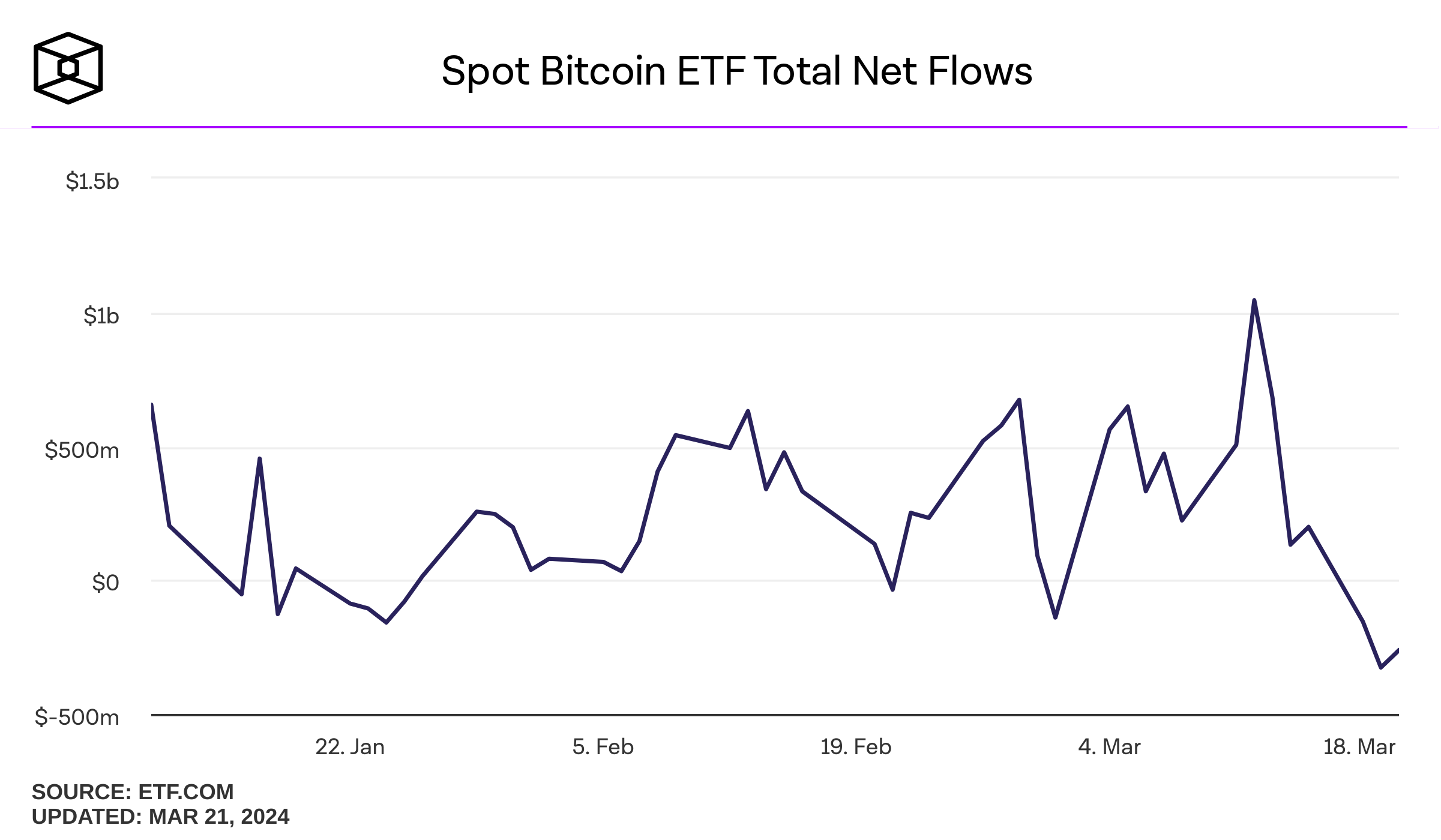

The period from March 17 to 19, 2024 saw the outflow of more than half a billion dollars from Bitcoin investment funds. Which coincided with Fall in price of digital currency By more than 9%.

However, March 20 saw a significant rise in the price of Bitcoin despite continued investment fund outflows worth $260 million.

Overestimation of the impact of ETF flows Bitcoin on the cryptocurrency market

Analysts believe that the main reason for this rebound is... Announcement from the US Federal Reserve (Central Bank) announced the possibility of reducing interest rates three times during the current year. This is a favorable factor for high-risk assets such as cryptocurrencies.

The analysis highlights the need to consider macroeconomic factors in addition to investment fund flows. Positive news on the macroeconomic front could offset the impact of the exit of investments from cryptocurrency funds, at least in the short term.

“People overestimate the impact of crypto ETF inflows on the broader cryptocurrency market in the near term,” said Teddy Fusaro, an analyst at Bitwise.

Fusaro added: “The average daily trading volume in... Cryptocurrency spot market generally Scholarships Nearly $100 billion. Meanwhile, Bitcoin ETFs saw a net outflow of $262 million yesterday as the market rose.

The author of the analysis concludes by saying that monitoring investment fund flows is important. But you shouldn't focus too much on it in the short term. All the more so as market players become more accustomed to the fluctuations in these flows and their decreasing impact on prices.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,الأسواق,العملات الرقمية,بيتكوين,صناديق ETF

Comments

Post a Comment