Bitcoin is facing a severe liquidity crisis as demand for the digital currency reaches unprecedented levels.

According to CryptoQuant analysts, monthly demand has increased from 40,000 BTC at the start of the year to 213,000 BTC at present. This increase is due to a growing total balance of accumulator addresses, indicating increased investor interest in securing Bitcoin.

Bitcoin liquidity crisis hits the cryptocurrency market

Bitcoin exchange-traded funds (ETFs) in the United States are significantly contributing to the increased demand for Bitcoin. These ETFs, with the exception of GBTC, have seen their Bitcoin holdings swell. Indeed, from February 25 to March 17, its balances increased from 117,000 to 185,000 BTC.

This trend also reflects the crucial role that institutional investments via spot ETFs play in amplifying demand for Bitcoin.

Additionally, demand for Bitcoin among its largest holders, or “whales,” is also seeing a corresponding increase. Year-over-year growth in the total balance of Bitcoin whales – those owning between 1,000 and 10,000 BTC – reached an all-time high of 1.57 million BTC, representing a significant acceleration from 874,000 BTC from the beginning of 2024.

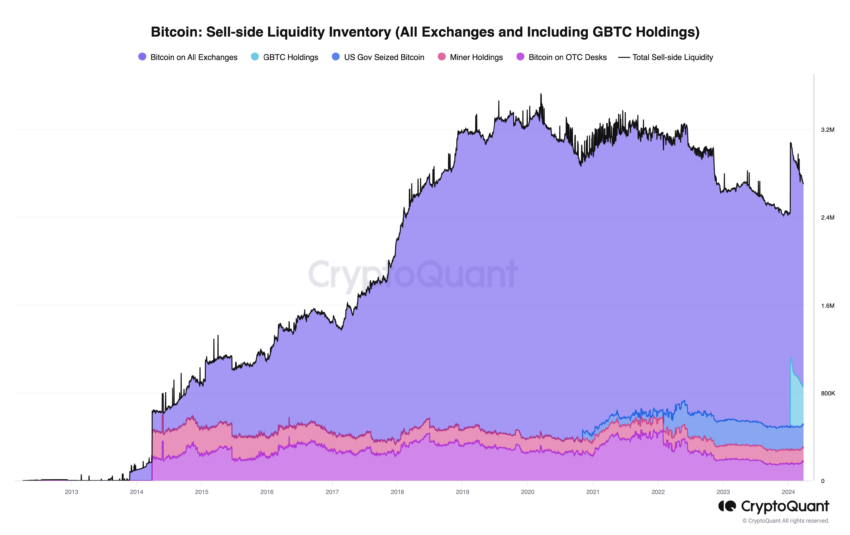

At the same time, sell-side Bitcoin liquidity is experiencing a downward trend. The total visible amount of Bitcoin in major entities fell to 2.7 million BTC. This represents a sharp drop from its all-time high of 3.5 million BTC in March 2020.

This imbalance between record demand and low liquidity on the sell side has also led to a historic decline in Bitcoin's liquid supply. Current sell-side liquidity is estimated to only be able to meet increased demand over the next 12 months, assuming only demand from lagging addresses.

This situation becomes even more critical when considering the exclusion of Bitcoin on exchanges outside the United States, with liquid stocks reduced to just six months of demand. This exclusion is based on the assumption that US Bitcoin spot funds traded in the United States primarily source Bitcoin from within the country.

“Record demand for Bitcoin combined with low liquidity on the sell side has led liquid Bitcoin inventories to fall to an all-time low in terms of months of demand...a decline in liquid inventories should support higher prices ", wrote CryptoQuant analysts.

Read more: Will Bitcoin Reach a New High in 2024?

The convergence of these factors suggests a bullish future for the price of Bitcoin. Indeed, he added Ki Young Joo, CEO of CryptoQuant, said that under these conditions, price corrections “result in a maximum pullback of around 30% in bull markets, with a maximum pain of $51,000.”

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, action or decision taken by the reader in accordance with this information is solely the responsibility of it and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,تحليل البيتكوين (BTC)

Comments

Post a Comment