Bitcoin Price History (BTC) hit all-time highs last week and has since triggered a correction that sent the cryptocurrency down 7.74%.

However, in the chaos of bearish sentiment, a single action by Bitcoin investors could prevent a catastrophic correction.

Bitcoin price saved by its users

Bitcoin is already trading at $67,768 at the time of writing, up from $68,393 since the start of the trading session. This leads to ongoing corrections that have seen the cryptocurrency miss the 50-day exponential moving average (EMA).

However, Bitcoin is still above the critical support level set at $63,724, which could lead to significant losses for investors. The reason is the conviction of BTC holders who have consistently enriched their portfolios despite market conditions.

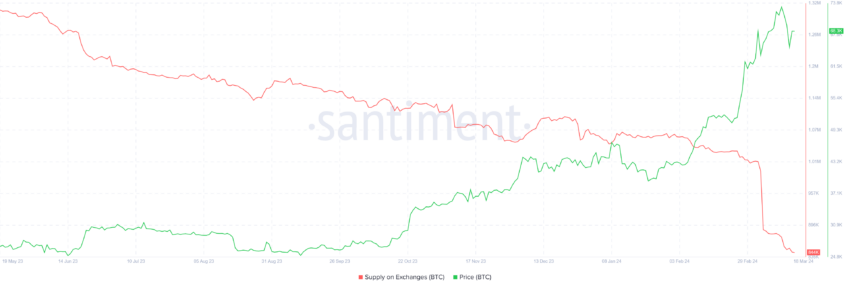

In the past week alone, approximately 36,640 Bitcoins worth over $2.5 billion left exchange wallets. Interestingly, whales are not accumulating at the moment, meaning it is retail investors who are accumulating at the moment.

In fact, their conviction is also strong in the derivatives market. The lack of long-term liquidation has made them optimistic, suggesting traders are still betting on price increases.

These efforts will be essential to help the Bitcoin price maintain its sideways movement path on the daily chart and avoid a catastrophic collapse.

BTC price forecast: be careful at this level

Bitcoin price is expected to stay above the $60,000 level and maintain the $63,724 level as a support floor.

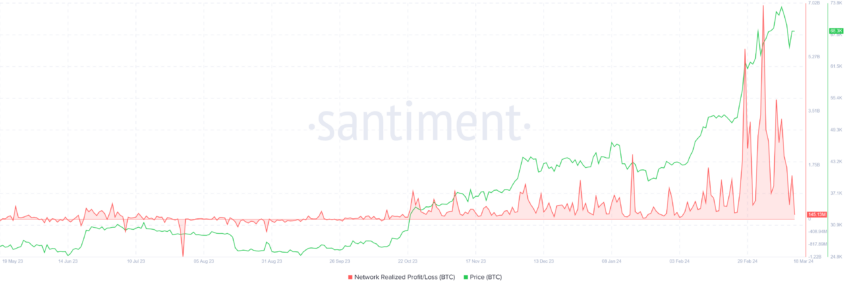

However, the fact that profits remain high cannot be ignored. Realized profits, which refers to gains recorded on-chain after coins move through addresses, show high potential for making profits.

This adds to the falling prices and indicates that Bitcoin investors may choose to sell their holdings to make a profit.

Therefore, Bitcoin price will suffer and may fall to $63,724. Missing this support would invalidate the bullish thesis and leave Bitcoin vulnerable to a decline to $60,000.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, action or decision taken by the reader in accordance with this information is solely the responsibility of it and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,البيتكوين,العملات الرقمية,العملات المشفرة

Comments

Post a Comment