attest Cryptocurrency market A new qualitative leap with success Bitcoin BTC Price A new surprising achievement by surpassing the $56,000 mark for the first time since November 2021. On Tuesday morning, Asian time, Bitcoin recorded a meteoric rise of 10%, bringing its price back above the $57,000 level.

The positive impact was not limited to Bitcoin, but extended to the entire market. Other digital currencies made notable gains, as the second-largest cryptocurrency rose, Ethereum (ETH), by 4.7% in the last 24 hours. Which broke the $3,200 barrier this morning in Asian trading.

There is also clear enthusiasm for Ethereum, due to the anticipation of its ETFs being approved later this year, in May.

Factors Pushing Bitcoin Price Up

Bitcoin's rise was expected, but the timing and speed at which it rose surprised some. As most expectations indicated a possibility Correction occurs After the previous bullish wave, the price entered a state of consolidation and sideways trading.

A number of infiltrating factors have combined to cause this notable increase:

Strong demand for Bitcoin ETFs

Bitcoin exchange-traded funds (ETFs) saw a record trading volume of $2.4 billion last Monday. This reflects the growing demand from large investors for this asset class.

The halving date is approaching

Also eclipsing the market is a “halving” event, a technical term that refers to the periodic event in which Bitcoin mining rewards will be cut in half, which is expected to occur over the next two months.

This will make it more difficult to mine new Bitcoins. This will create upward pressure on prices due to the lack of supply compared to growing demand.

Hedging Bitcoin Short Sales on Futures Markets

The two previous factors, especially the first, led to a gradual increase in the price of Bitcoin (BTC). This led to the liquidation of many short Bitcoin contracts in the futures market.

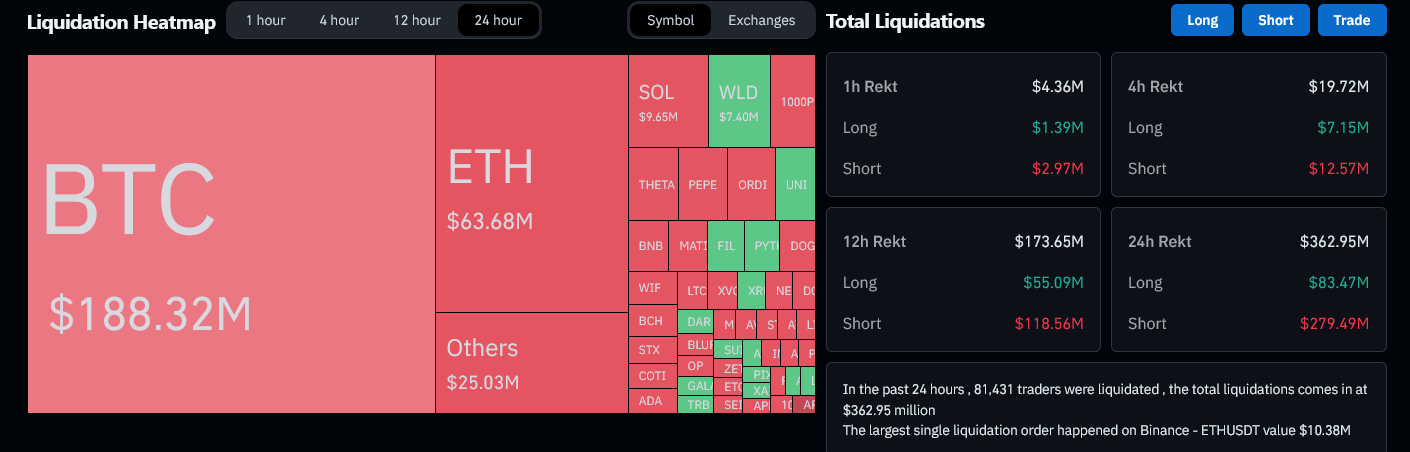

Short-selling coverage has also contributed to Bitcoin's sharp rise since the start of this week. Where it appears Data from CoinGlass Short sale trades have lost more than $188 million to the selloff since Sunday.

However, futures volumes, or open interest, rose from $48 billion to nearly $54 billion, indicating an increase in bullish bets.

Data shows that the liquidation rate of short sale contracts has increased significantly in recent days. This indicates that many traders were forced to exit their positions due to the rapid price rise.

This decision marks a significant change from the downward trend observed in recent months. Cryptocurrencies have come under significant selling pressure due to concerns over regulation and market liquidity. However, sentiment appears to have changed now, with growing interest from institutional investors and an increase in trading volume.

It remains to be seen whether this recent price rally will continue or meet resistance at higher levels. However, current dynamics suggest that the market may be on the path to recovery after a period of weakness.

Explain the concept of hedging short sale transactions

Short covering means that the trader closes the short sale position he previously opened by purchasing the asset in question at the current market price.

A short sale contract is a trading strategy that allows traders to bet on a decline in asset prices. To do this, a trader borrows an asset (like a stock) and sells it in the market at the current price. Then buy it later at a lower price when he expects its price to fall.

The difference between the sale price and the subsequent purchase price represents the profit (after deduction of any fees or interest linked to the loan). This strategy carries high risk because losses can be unlimited if the price of the asset rises instead of falls.

Read also: Shorting Bitcoin: is it possible to profit from it?

However, if the price of the asset rises instead of falling, the trader faces losses that increase as the price continues to rise. In this case, the trader may choose to "hedge" their losing trade by purchasing the asset at the current price to avoid greater losses.

This purchase may also lead to increased demand for the asset, which could drive the price higher. This is called “short selling” or “short squeeze”.

A “Short Squeeze” occurs when upward pressure is caused in the market. Traders who have opened short positions quickly close their positions to avoid further losses, leading to a sharp increase in the price of the asset.

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, action or decision taken by the reader in accordance with this information is solely the responsibility of it and its affiliates individually, and the site assumes no legal responsibility for such decisions.

Comments

Post a Comment