Well-known analyst within the cryptocurrency neighborhood Max Kaiser pridect The value of Bitcoin (BTC) has risen sharply to $500,000 amid a large collapse within the US inventory market.

Kaiser cites knowledge from the Copisi letter that reveals a worrying focus in blue-chip shares not seen for the reason that Great Depression. This signifies that the market is on the brink.

Will Bitcoin turn into a secure haven amid the market collapse?

Kaiser compares what occurred to the 1987 crash, suggesting that Bitcoin will turn into a secure haven for buyers. It even discusses potential actions by the US authorities, highlighting their harmful potential.

“Bitcoin will continue to distort gold. ETFs and miners will be confiscated by the US government. One million middle- and upper-class immigrants will flock to El Salvador,” Kaiser mentioned.

Arthur Hayes, co-founder of BitMEX, additionally factors out that low liquidity and monetary difficulties might be a harbinger of a market decline.

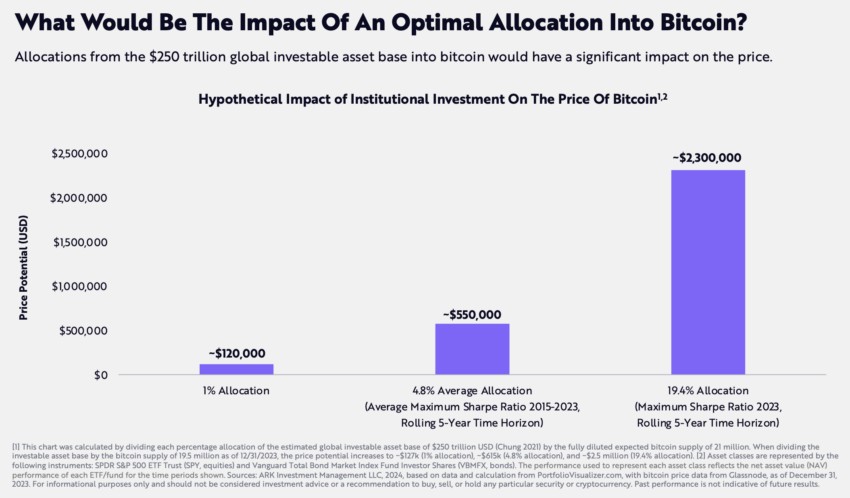

Against the backdrop of those bleak forecasts, ARK Invest provides a bolder estimate for Bitcoin at $2.3 million per BTC. ARK's evaluation signifies that over the previous seven years, the asset has considerably outperformed conventional funding autos by way of common annual returns.

The authors of the ARK report advocate for Bitcoin's inclusion in diversified funding portfolios, citing the potential for improved risk-adjusted returns. In their opinion, even a slight redistribution of funds from international belongings can considerably enhance the worth of Bitcoin: a 1% influx of capital will elevate its value to $120 thousand, and 4.8% to $550 thousand.

While these forecasts are speculative, they mirror rising confidence amongst market contributors in Bitcoin's resilience and potential as a significant monetary instrument.

Stay in contact! Subscribe to Cryptocurrency.Tech at cable.

Bitcoin

Comments

Post a Comment