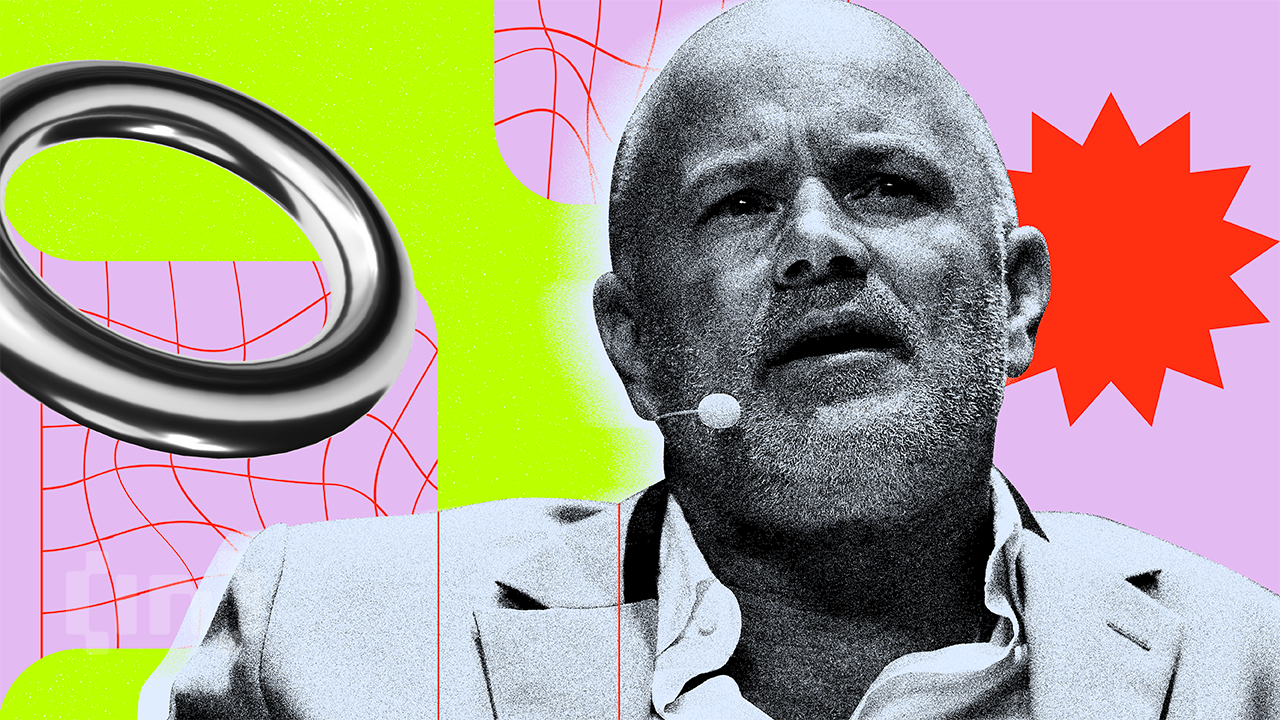

Michael Novogratz, CEO of cryptocurrency investment firm Galaxy Digital, offered a clear-eyed look at the future... Bitcoin price BTC. While he acknowledged short-term risks, such as a potential price drop to $42,000, his overall tone was positive over the long term, driven by institutional adoption and a more mature market.

Novogratz expressed confidence in Bitcoin's long-term prospects, despite possible price declines due to market dynamics or regulatory issues. One of his biggest fears was that the market would overheat, leading to sell-offs and regulatory uncertainty.

He said in interview From CNBC: "You know, there could be some regulatory disruption."

Institutional adoption by the growing ETF sector, which manages $42 trillion, will fuel future growth, he said. Combined with rising investor demand, the leading cryptocurrency could reach and surpass its previous peak.

Institutional capital: new hope for Bitcoin?

Despite the near-term uncertainty, Novogratz emphasized the transformative power of Bitcoin adoption by financial institutions. He pointed to the growing market for Bitcoin ETFs. Highlighting its ability to unlock $42 trillion in wealth managed by brokerage firms.

Read also: Why is it worth keeping an eye on this important indicator after the Bitcoin price rose to $52,000?

Novogratz also emphasized the importance of this institutional adoption, stating: “This flow of institutional interest... not only strengthens the cryptocurrency space, but also heralds a period of consolidation (lateral trading) and subsequent rally.” He believes this trend is unstoppable and will see Bitcoin finish the year at a “much stronger pace.”

Meanwhile, Galaxy Digital acquired a large amount of Ethereum (ETH) worth about $76 million. Lookonchain, a company that tracks chain data, reported that this transaction was carried out by withdrawing funds from Kinbase Kinbase Prime And Binance (Binance).

The Pains of Transitioning from the Wild West to Wall Street

Novogratz acknowledged the challenges of moving an emerging market into the mainstream. He views the current regulatory uncertainty as “growing pains” that will ultimately lead to a more stable and regulated crypto world.

Interestingly, he noted growing pressure from customers on financial institutions to offer Bitcoin products. This highlights the growing demand for regulated access to this asset class.

According to Novogratz, Bitcoin may struggle in the near future. With the possibility of price adjustments due to market dynamics and regulatory uncertainty.

However, his long-term optimism remains unwavering, fueled by the transformative power of corporate adoption. Expected period of consolidation and maturity of the digital currency market.

Lee Bitcoin price Whether it reaches its previous peak of $69,000 will depend on its ability to overcome these short-term challenges and capitalize on the long-term trends shaping its future.

Denial of responsibility

All information published on our website is offered in good faith and for general information purposes only. Therefore, any actions, actions or decisions taken by the reader in reliance on this information are solely the responsibility of it and its affiliates individually, and the site does not accept any legal liability for these decisions.

الأخبار

Comments

Post a Comment