As the cryptocurrency market continues to evolve, Bitcoin remains... BTC At the forefront of investors' interests. This is supported by the recent price performance, which exceeded $60,000.

In a detailed analysis, trading expert Peter Brandt provided a convincing prediction of the price development of Bitcoin. He linked its potential to cryptocurrency halving events. This is a mechanism that halves the reward for mining new blocks. Thus, this reduces the supply of new Bitcoins and often causes prices to rise.

Bitcoin Price Prediction: Is $400,000 Next?

reveal Systematic review Brandt's investigation of previous Bitcoin bull cycles in relation to their halving dates reveals a pattern of significant growth phases that accompany these events. Through an analysis spanning more than a decade, Brandt highlights the predictive power of these cycles. This indicates an optimistic future for the price of Bitcoin.

The trading expert noted the historical symmetry in the duration of uptrends before and after each halving. With the next halving scheduled for April 2024, Brandt's forecast suggests a bullish outlook for Bitcoin.

According to his analysis, if price increases after the halving repeat the pattern of previous cycles, Bitcoin's value could reach notable levels. In fact, expect goals of $150,000, $275,000 and even $400,000.

“If the pace of the uptrend after April 2024 is similar to that seen since the November 2022 low, the October 2025 rally could reach around $150,000,” Brandt said. “However, the progression after the halving during previous bull cycles has “Lots of progress before the half.”

To further fuel the bullish trend, CryptoQuant analysts provided BeInCrypto with a quick overview of the current market dynamics driving the price of Bitcoin. The recent rise to $64,300, the highest since November 2021, confirms the strong demand from large American investors.

This demand is reflected in the increase in holdings of large Bitcoin entities and the influx of new capital into the market, as evidenced by the increase in the value of short-term holders.

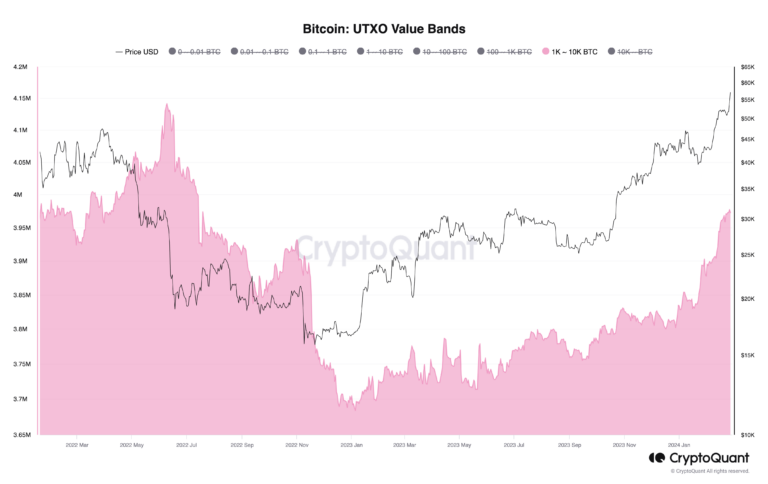

“Bitcoin holdings of large entities reached their highest level since July 2022, totaling 3.975 million BTC. “Holdings have increased steadily since a low of 3.694 million BTC in December 2022. Large entities (1,000 to 10,000 BTC) expanding their holdings is associated with “Rising prices. Because this indicates increased demand for Bitcoin for investment purposes,” CryptoQuant analysts told BeInCrypto.

CryptoQuant's analysis also highlights the sustainability of current price levels from a miner profit perspective. Analysts noted that Bitcoin's valuation remains reasonable, despite the recent rise.

However, they warned of possible corrections in the market, citing indicators such as approaching maximum levels of unrealized profit margin among traders and the high cost of opening new long positions in the market eventually.

Despite these warning signs, expert sentiment remains optimistic. The confluence of historical data, current market trends, and the expected impact of the next halving event paints a picture of Bitcoin's significant growth potential.

This optimism is based on solid foundations, as Bitcoin has shown resilience and a consistent ability to reach new highs following the last halving.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,البيتكوين,العملات الرقمية,العملات المشفرة

Comments

Post a Comment