Bitcoin reached a brand new yearly excessive of $52,800 on February 15, however has fallen barely since then. We are contemplating whether or not we count on progress within the route of $60,000.

Bitcoin closed above $50,000.

The weekly time-frame reveals that BTC has been on the rise because the starting of 2023. The bullish transfer accelerated in October and took the worth to a excessive of $49,050 in January 2024.

Bitcoin then fell, testing the 0.618 Fibonacci retracement degree as resistance (Red icon) and fell to $38,500.

The coin then began to get better and shaped 4 weekly bullish candles. This rally peaked finally week's shut at $52,900, the very best intra-week shut since 2021.

However, regardless of the bullish value dynamics, the weekly Relative Strength Index (RSI) is giving unfavourable indicators. Although it was greater, it shaped a bearish divergence, which regularly precedes downtrend reversals.

What analysts say

Cryptocurrency merchants and analysts on the X platform have a optimistic outlook on Bitcoin's prospects.

Cryptomational BelievesThe value will attain $100,000 earlier than the halving. CrediBULL Crypto signifies that the worth might retest $50,000 after which transfer greater:

“In fact, I still think we have a good chance of testing it even if we hit the local highs first. Ideally, we can form a nice range between the new local highs and the green zone. This would be great for opening/building positions.”

Matthew Hyland maleThis is the primary time BTC value has closed earlier than the halving above the long-term resistance degree of 0.618 Fibonacci.

BTC Forecast: Where is the native high?

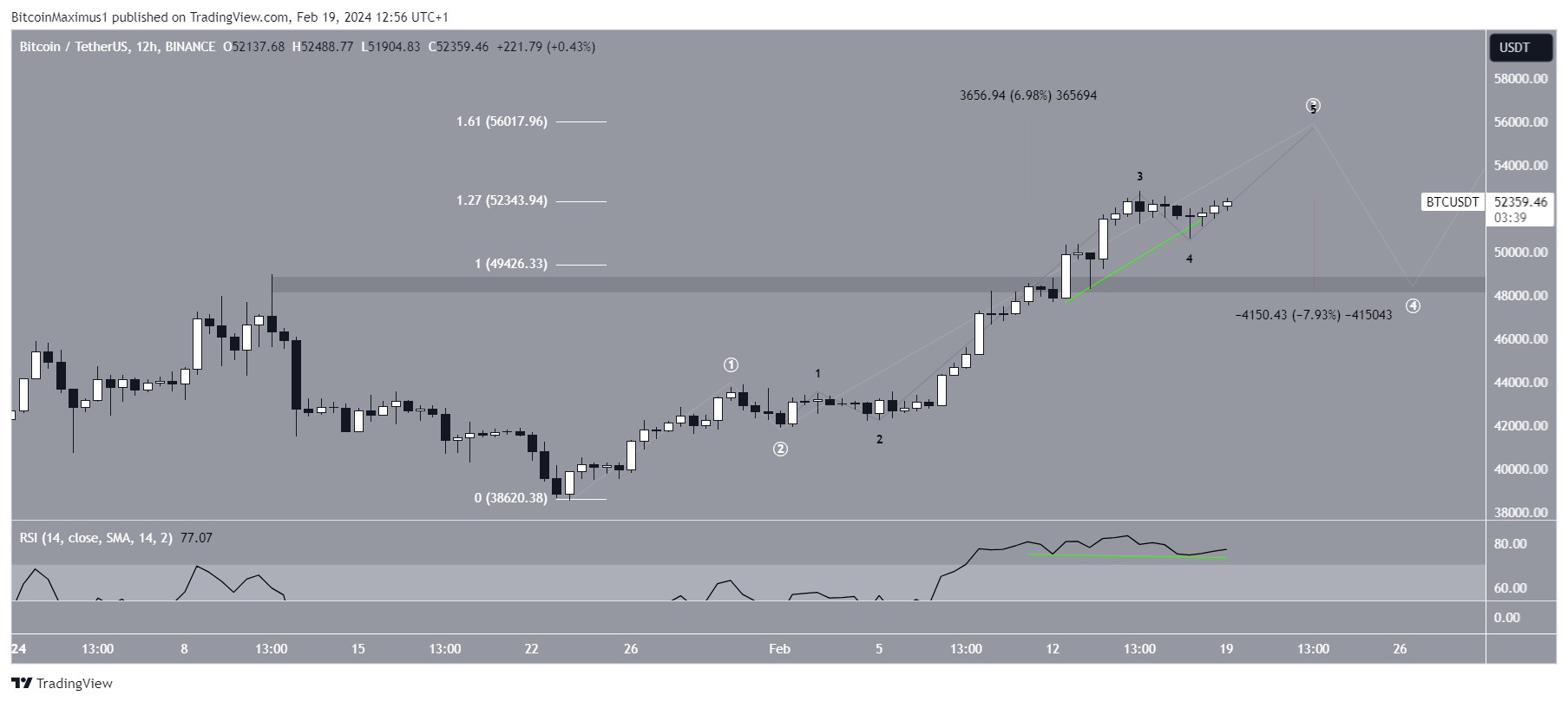

The 12 hour time-frame helps progress. The value motion on this chart reveals Bitcoin buying and selling above the 1.27 Fibonacci degree of the exterior retracement of the earlier low of $51,800, which is now anticipated to offer help to the worth.

This upward motion can also be supported by the Relative Strength Index, which has shaped a hidden bullish divergence (inexperienced shade) and it grows.

Finally, Elliott Wave evaluation means that Bitcoin might submit one other rally earlier than a correction.

The most probably state of affairs means that Bitcoin is within the third wave of a five-wave upward transfer (White shade). The sub-wave evaluation is proven in black and reveals that the worth is within the fifth and ultimate sub-wave.

The most probably degree for the highest of the rise is $56,000 (1.61 Fibonacci resistance degree, an exterior correction of the earlier decline). This is roughly 7% greater than the present value. After that, Bitcoin value might appropriate as a part of the fourth wave.

Despite the bullish outlook, Bitcoin's failure to shut above the $52,350 resistance space will finish the third wave. This would result in an 8% drop to fast help at $49K.

Stay in contact! Subscribe to Cryptocurrency.Tech at cable.

Bitcoin

Comments

Post a Comment