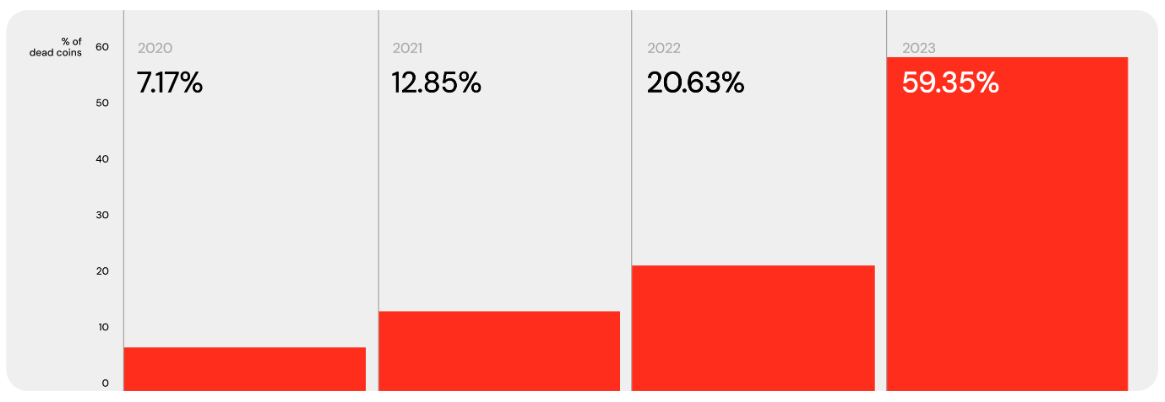

For cryptocurrency initiatives, 2023 was the hardest 12 months within the final four-year cycle – throughout this era, builders deserted 59.35% of tokens tracked on CoinMarketCap. This is evidenced by analysis Alpha Quest.

Percentage of “dead” currencies from 2020 to 2023. Data: AlphaQuest.

Percentage of “dead” currencies from 2020 to 2023. Data: AlphaQuest.

High mortality price

Analysts studied greater than 12,000 initiatives and recognized “dead” initiatives in keeping with 4 standards:

- Low liquidity/buying and selling quantity — 92.6%;

- Broken web site - 50.9%;

- Excluded from CoinMarketCap checklist - 47.6%;

- Deleted X account - 35.6% (no updates on X for greater than three months - 26.9%).

Experts additionally pointed to fraud circumstances the place attackers bought or gained entry to deserted venture accounts to advertise a rip-off.

“By analyzing social media activity, investors can stay informed and cautious in the world of cryptocurrencies,” AlphaQuest recollects.

Market liquidation

Analysts level out that 72% of cryptocurrency initiatives (3,473 out of 4,834) that emerged throughout the 2020-2021 bull cycle additionally failed.

Researchers have pointed to vital unfavourable penalties of enormous bankruptcies. After the collapse of the Terra ecosystem, greater than 35% of the cash ceased to exist. The collapse of the FTX change took one other 32% of the tokens.

“These statistics highlight the sensitivity of cryptocurrency projects to market volatility and highlight the importance of risk management in this volatile area,” the researchers added.

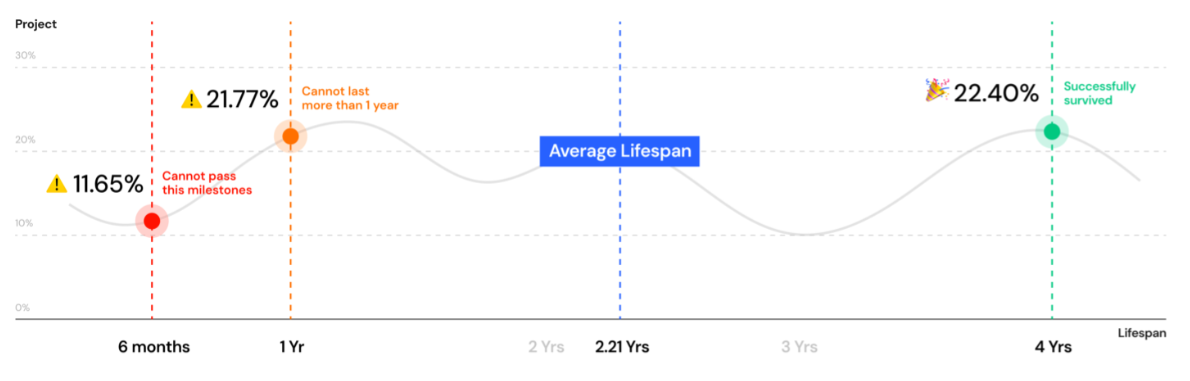

The common lifespan of startups within the digital asset trade is three years, in keeping with AlphaQuest calculations. This signifies that a typical venture is “unlikely to survive a four-year market cycle.”

Lifespan of crypto initiatives. Data: AlphaQuest.

Lifespan of crypto initiatives. Data: AlphaQuest.

According to analysts, solely 22.4% of cryptocurrency initiatives exist longer than the required interval. Dead cash dwell a mean of solely 2.21 years.

Victims

AlphaQuest has recognized a number of classes of the cryptocurrency trade the place greater than 50% of initiatives not exist:

- Video and music - 75%;

- Asset-backed stablecoins - 75%;

- Metaverse - 51%.

The most affected ecosystems have been Cardano and Terra, with 74% of the venture “dead” for every. Cielo, Harmony, Nair, Zilliqa and Monriver additionally suffered vital losses.

In addition, half of the startups backed by the failed hedge fund Three Arrows Capital failed. Other VC companies that noticed greater than 50% of their cryptocurrency portfolio exit: Paradigm, DWF Labs, Polychain Capital, Andreessen Horowitz, Animoca Brands, Binance Labs, and Multicoin Capital.

Previously, CoinGecko specialists calculated this because the clip appeared GameFi About 2,127 initiatives out of two,817 on this route failed.

Stay in contact! Subscribe to Cryptocurrency.Tech at cable.

Cryptocurrency

Comments

Post a Comment