The professional admitted that the massive inflow of capital into Bitcoin exchange-traded merchandise in the long run threatens gold's place as a main retailer of worth. Writes about this Bloc.

Head of Research at ETC Group, Andrei Dragos, drew consideration to the rising divergence between flows related to cryptocurrency funds and gold.

“This may be the first sign that bitcoin is stealing the crown from gold as the world's leading store of value,” he mentioned.

The overwhelming majority of latest cryptocurrency investments are believed to be in US-listed exchange-traded funds, the analyst added.

“These new ETF flows are becoming increasingly important to Bitcoin’s overall performance,” Dragos mentioned.

According to ETC Group, web inflows to... ETP The cryptocurrency's year-to-date foundation rose considerably in February. This pattern is due partly to a slowdown in capital withdrawals from the Grayscale Bitcoin Trust ETF. Against this background, there may be an inflow of cash from gold.

According to BitMEX analysis, the overall worth of Bitcoin exchange-traded funds within the United States elevated over the previous week by $2.3 billion, with the majority of the influx supplied by BlackRock's iShares Bitcoin ETF.

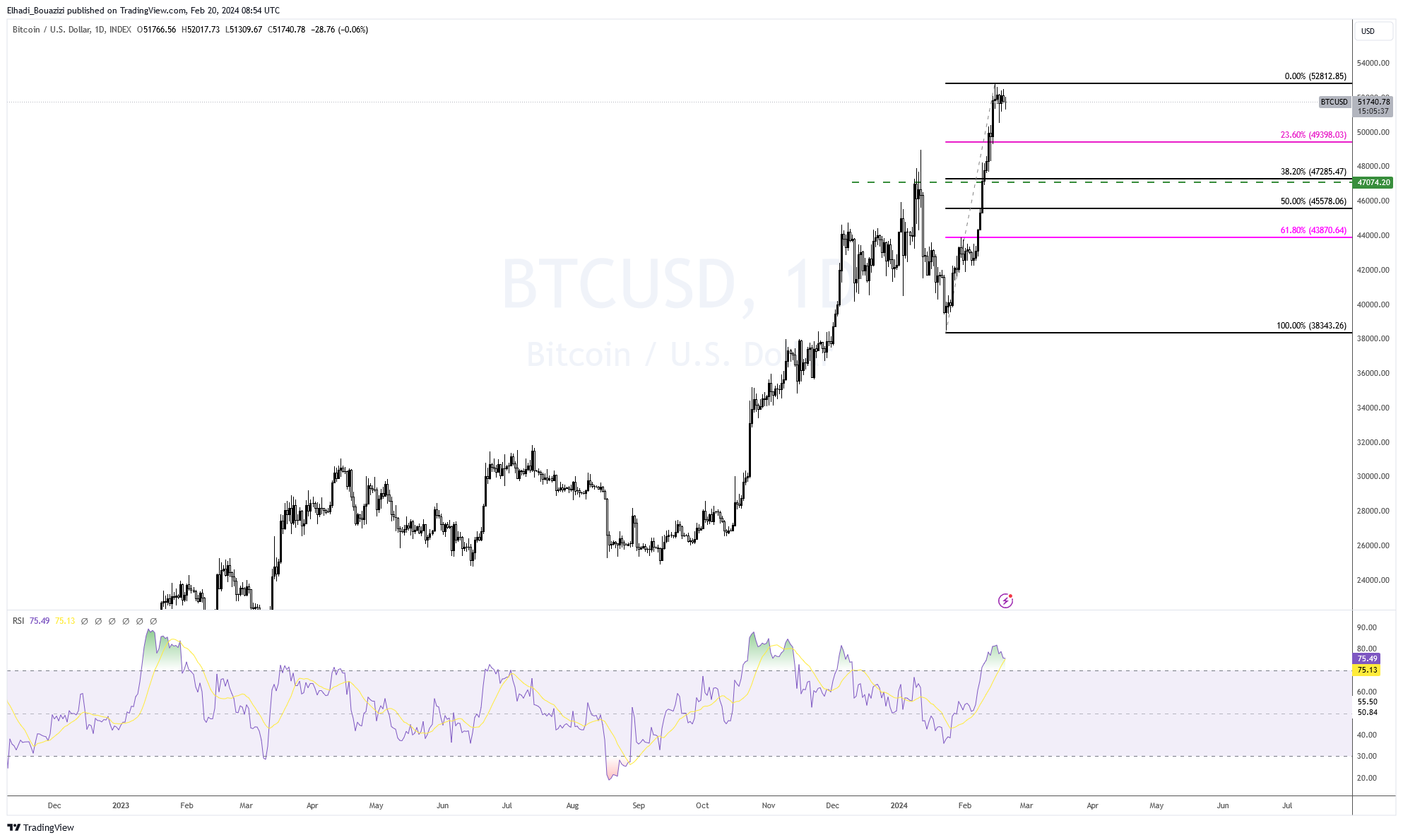

And this is the picture once more if you cannot see the unique https://t.co/TphjGxSaOx pic.twitter.com/03cNf7eeRH

— BitMEX Research (@BitMEXResearch) February 17, 2024

Ryze Labs analysts additionally famous that because the starting of the 12 months, buyers have withdrawn $2.4 billion from the 14 largest gold-based ETFs, whereas Bitcoin merchandise recorded an influx of $3.89 billion.

“This trend strengthens our confidence in Bitcoin’s dual role as a risky investment and a safe haven asset. We continue to believe that the cryptocurrency will outperform gold in both market guises,” the specialists mentioned.

Dragos expects this pattern to proceed in the long run and “eventually Bitcoin will undermine gold’s position as a primary store of value.”

However, he emphasised that the present worth of gold ETFs is roughly thrice larger than the mixed worth of comparable cryptocurrency merchandise.

“In this regard, Bitcoin funds may be able to overtake gold-based instruments in terms of capitalization in the next two years due to rising prices,” the professional believes.

Over the previous 30 days, the worth of the main cryptocurrency has elevated by 25% (Queen Gekko). The asset is buying and selling at ranges close to $52,000.

Stay in contact! Subscribe to Cryptocurrency.Tech at cable.

Bitcoin

Comments

Post a Comment