The group of companies has raised a staggering $13.70 billion in Bitcoin (BTC). This represents an important milestone in the cryptocurrency market.

The massive accumulation reflects growing confidence in Bitcoin as a viable investment. It also reflects recent price increases and growing appeal among institutional investors.

ETF issuers are buying $13.70 billion worth of Bitcoin.

Exchange-traded funds shine brightly in the spotlight (ETF) for Bitcoin. These financial products saw strong capital inflows, exceeding $2.2 billion between February 12 and 16. This increase in investment is pushing Bitcoin ETFs to outperform US ETFs. Of which there are 3400 boxes.

Bloomberg analyst Eric Balchunas emphasized the absolute dominance of these inflows. He specifically pointed to BlackRock's iShares Bitcoin Trust (IBIT), which earned $1.6 billion in just one week.

"10 Bitcoin ETFs earned over $2.3 billion last week... IBIT alone was in second place. That brings the net total to over $5 billion, which is more than BlackRock earned as a whole. Again, this is all pure bleeding from GBTC explained Balciunas: “Take that away and the numbers get even crazier.”

This is evidence of growing investor appetite for Bitcoin. In fact, large inflows into other prominent Bitcoin ETFs are further evidence of this. For example, Fidelity's Wise Origin Bitcoin Fund and 21Shares' Ark Bitcoin ETF also saw significant capital infusions, reflecting diversified interest in Bitcoin investments.

Despite the bullish inflows, the Grayscale Bitcoin Trust faced $624 million in outflows. However, the overall picture remains optimistic as spot Bitcoin ETFs have been approved by the US Securities and Exchange Commission (SEC).

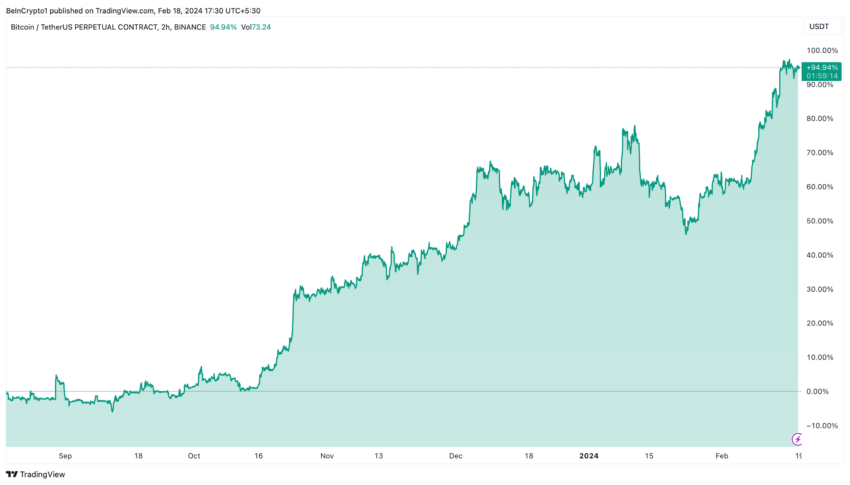

This regulatory approval has led to a rise in the price of Bitcoin, which has risen 95% over the past six months, reflecting the market's positive sentiment towards cryptocurrencies.

Bitcoin's renewed appeal isn't just limited to ETFs. Major banks and financial institutions are closely monitoring the market. Some are calling for regulatory changes to meet the growing demand for Bitcoin storage. This reflects wider recognition of Bitcoin's potential to redefine investment portfolios and its role as a modern asset class.

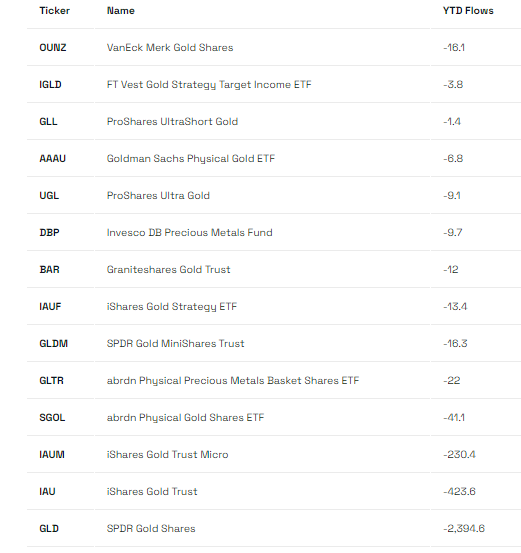

Investors are dumping gold assets into ETFs

Bitcoin's growth is reflected in its comparative performance compared to traditional safe-haven assets such as gold. The digital currency's 23% annual growth stands in stark contrast to gold's modest decline. Thus, this highlights the shift in investor preferences towards digital assets.

This shift is evident in the significant outflows from gold ETFs, a trend that stands in stark contrast to the previous year's inflows.

As Balchunas states: "The situation is pretty bad in the gold ETF category right now. I certainly don't think it's people migrating to Bitcoin ETFs, maybe a little, but more likely it's just FOMO for our stocks." may be reflected in the light of new environmental data."

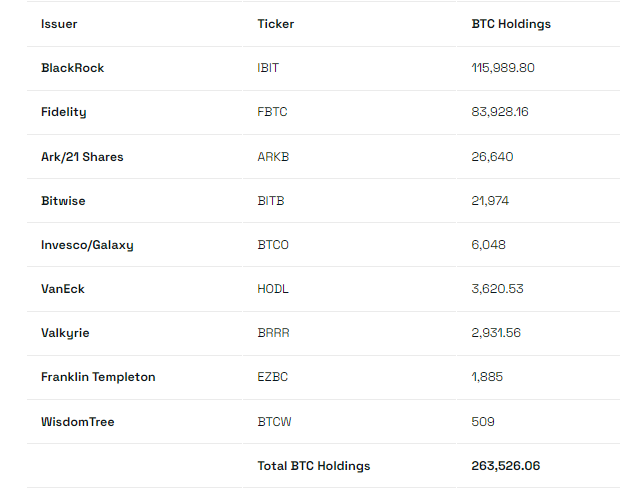

A group of companies accumulating Bitcoin, including BlackRock, Fidelity, Ark/21 Shares and Bitwise, among others, are signaling a turning point in financial markets. These organizations, holding 263,526.06 BTC, are pioneers of the financial revolution.

As Bitcoin continues to challenge traditional investment models, its acceptance among institutional investors is ushering in a new era of integrating digital assets into mainstream financial portfolios.

Denial of responsibility

All information published on our website is offered in good faith and for general information purposes only. Therefore, any actions, actions or decisions taken by the reader in reliance on this information are solely the responsibility of it and its affiliates individually, and the site does not accept any legal liability for these decisions.

أخبار,العملات الرقمية,العملات المشفرة,بتكوين,بيتكوين

Comments

Post a Comment